The sources of this presentation are mainly from the following papers and reports

- Securitized Banking and the Run on Repo – Gordon and Metrick (2012) (alternative Haircuts – Gorton and Metrick (2010))

- Long Shadows – Collateral Money, Asset Bubbles, and Inflation – Credit Suisse (2009) (or my highlighted parts)

- When Collateral Is King – Credit Suisse

- Shadow Banking – Pozsar et al. (2013)

together with this Zero Hedge article

I also used the following two videos

and

The ultimate goal would be to be able to understand – though not necessarily agree with – the following three Zero Hedge master pieces

- Desperately Seeking $11.2 Trillion In Collateral, Or How “Modern Money” Really Works

- The Fed Has Another $3.9 Trillion In QE To Go (At Least)

- $707,568,901,000,000: How (And Why) Banks Increased Total Outstanding Derivatives By A Record $107 Trillion In 6 Months

And as these articles are a little bit older (and focus on the negative), here is the most recent update by the IMF:

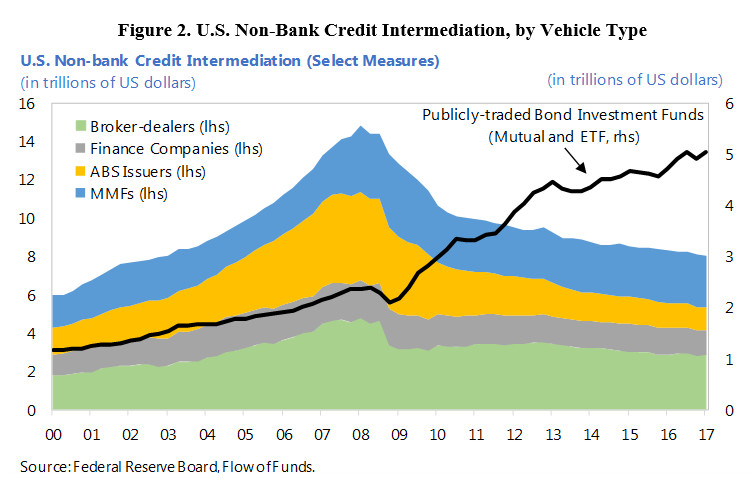

With this being the most important chart:

For further reading on finance, I also highly recommend Danielle DiMartino Booth’s latest book Fed Up: An Insider’s Take on Why the Federal Reserve is Bad for America and David Graeber’s book Debt: The First 5,000 Years.

If you prefer movies, I would suggest the classic The Big Short (or the book version) and the far lesser known Money for Nothing: Inside the Federal Reserve.

I am currently categorizing all my favorite Zero Hedge articles here, though this is a project in progress, here is a more narrowed down list of my favorite shadow banking articles.