Arguably the most undervalued asset on Wall Street are history books.

— Luke Gromen

This quote from Volume 1 is still as relevant as ever. The first book was excellent and given Luke’s great track record, this sequel did not disappoint either (except maybe in the fact that it stopped in January of 2019.)

While waiting for Volume 3, I highly recommend following Luke on Twitter as things continue to accelerate, now turbocharged by the coronavirus. Or hopefully not given this tweet:

As usual, I also highly recommend you read first Volume 1 and then Volume 2 in their entirety; the books are succinct. Meanwhile here are my highlights of Volume 2 (and here for Volume 1) with some notes here and there. Or see my Twitter thread.

Most important chart from Volume 1:

***

Abbreviations:

Fed: Federal Reserve (US Central Bank)

BIS: Bank of International Settlement (the central bank of central banks)

BoP: Balance of Payments

GoR: Gold/Oil

UST: US treasury bonds

USD: US dollar

CNY: Chinese Yuan (Chinese currency)

WTO: World Trade Organization

FX: Foreign Exchange

EM: “Emerging Markets”

***

CHAPTER 1: CHINESE YUAN BEARS SEEM TO BE MISSING SOMETHING CRITICAL

October 2017

A number of high-profile investors are negative on China and the Chinese yuan (CNY), based on analyzing China using traditional Emerging Market (EM) Balance of Payments (BoP) metrics. However, in one critical aspect, China is no longer an EM, yet these investors are analyzing China as if it still is; that may prove to be a grave error.

Historically, under the petrodollar system, EMs had to run current account surpluses (earn USDs on net) in order to buy oil and other commodities and to service any USD-denominated debt. In instances where EMs began to run deficits, they had to sell FX reserves to support their currencies; when they ran out of FX reserves, they suffered a currency crisis where their currency fell sharply versus the US dollar (Russia 1998, SE Asia 1997, Argentina 2001, etc.)

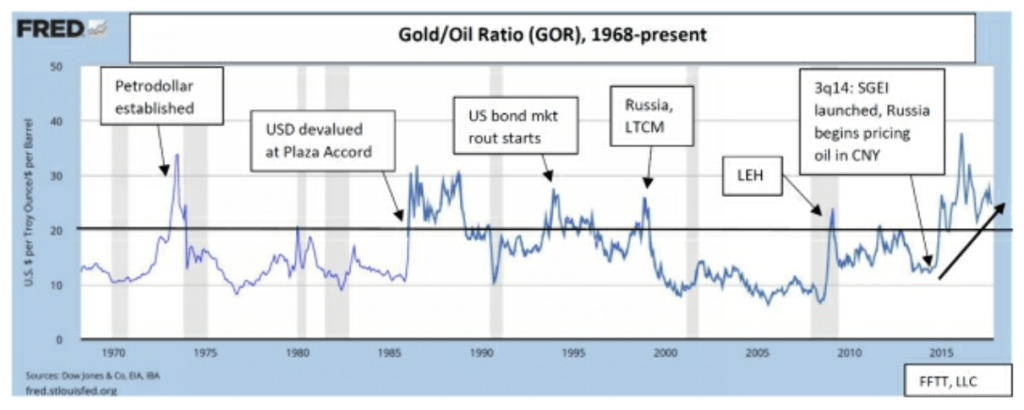

Pricing oil in CNY in the presence of an open gold window through CNY changes everything! Once China has a CNY oil contract (if it has even a modest degree of success), then whenever rising Chinese oil imports or rising oil prices begin to push the Chinese current account toward a deficit position (historically catastrophic for an EM), China can simply act in markets to increase the gold/oil ratio (GOR) it and its oil suppliers transact oil at, which gives China complete control over its energy bill.

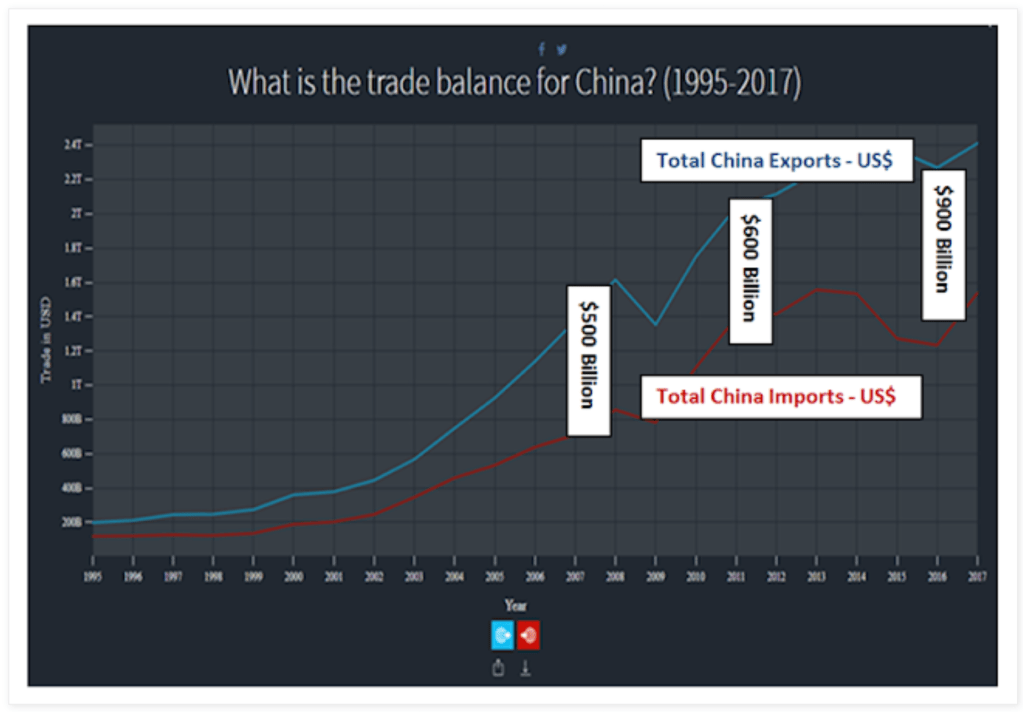

Source: http://atlas.media.mit.edu/en/profile/country/chn

Somewhere near 50 percent of China’s $1.3T in annual imports are commodities, all of which could at some point be subject to the same dynamic I just described in regards to oil—if they are priced only in USD and they rise in price, and/or China buys more of them over time, it will push China toward a current account deficit and a classic EM currency crisis unless China also begins to price those commodities in CNY as well.

What do we think will happen over the next few years as say $650B of annual Chinese commodity purchases are increasingly done in CNY, some sizable portion of which will likely be recycled into physical gold markets of which total annual global mine production is approximately $120B (and only approximately $90B ex-China and ex-Russia, since those countries aren’t selling their domestic mine production externally)?

American Vulnerability — The Dollar: Charles Duelfer – May 22, 2014

Look at the world (or even just the United States) from the position of China. What makes America a super power? Is it the military? Partly. Is it nuclear weapons? Not so much. What really gives us leverage is the position of the dollar as the base currency. In the last financial crisis, we escaped largely by printing money. Other countries can’t get away with that without causing massive inflation. Sitting in Beijing, it could be seen as a financial attack—US Treasury printing tons on dollars that has the effect of exporting inflation to other countries. We borrow money (by selling treasuries to finance our wars, debt, TARP, etc.) and then pay them off by, in essence, printing dollars.

The role of the dollar as base currency is a uniquely powerful lever. It is one that is rarely thought of in terms of national security, but nothing is more important. If we lose it, we will have lost our position as the last super power. Period.

Beijing, Moscow, and others are well aware of this. The role of the dollar also gives us the currently valuable tool of sanctions. If Washington decides to limit banking use of dollars for transactions with certain entities, e.g. in Russia or Iran, then we can impose our will on the international financial system. You can bet there is no higher strategic priority than to undermine that position.

We are blindly squandering this leverage from inattention and by our inability to control our appetite for printed dollars. This is a national security issue, not just a budget issue.

Domestic politics may make it convenient to be staring at our navel while waiting for the next election. However, the dynamics in the outside world and our shrinking position will effect our own standard of living here.

To see how the role of the dollar figures in international conflict, read James Rickards new book, “The Death of Money: The Coming Collapse of the International Monetary System.” While the title seems a little over the top, Rickards hits on some critical dynamics of an ongoing conflict that is not kinetic, but even more dangerous. There will be a moment when Washington wakes up. It’s only a question of when.

[Charles Duelfer spent over 25 years in the national security agencies of the US government. He was involved in policy development, operations, & intelligence in the Middle East, Africa, Central America, & Asia.]

Back then [in 1971], it was a run on US gold by the US’ EU creditors, who decided they no longer wanted to fund the Vietnam War and LBJ’s Great Society deficits. They demanded their gold back at $42, and despite all that demand, gold prices never budged… until the window was closed. Then gold rose twenty times in the next eight years.

CHAPTER 2: CHINA THREATENS TO CEASE BUYING USTS IN RESPONSE TO TRADE TENSIONS—MR. X’S THOUGHTS

January 2018

Luke: Whoa, whoa, whoa! You’re comparing the US’ current situation to that of Germany in the immediate aftermath of World War I?

Mr. X: Directionally, yes. There are some important differences, but this part of the quote was quite apropos in my opinion: “Were he to refuse to print the money necessary to finance the deficit, he risked causing a sharp rise in interest rates as the government scrambled to borrow from every source.” The Fed is going to be forced to do the same, much sooner than most investors think.

Luke: Why?

Mr. X: Germany lost a war. So has the US — the Global War on Terror hasn’t gone so well. Germany had a significant percentage of its manufacturing capacity seized by the Allies after the war, while the US has willingly offshored a significant percentage of its manufacturing capacity in response to “free trade deals” over the last twenty-five years.

That loss of German manufacturing capacity made it mathematically impossible for Germany to pay what were impossibly-large (as a percentage of German GDP), inflation-adjusting war reparations to the Allies in anything resembling real terms. Today, the offshoring of US manufacturing appears to have made it mathematically impossible for the US to pay impossibly-large (as a percentage of US GDP), inflation-adjusting entitlement obligations to its own people in anything resembling real terms.

The political situation in Germany post-World War I was, of course, far worse, but do tell me, Luke, is the domestic political situation in the US getting better or worse? More or less divided? (Smiling.)

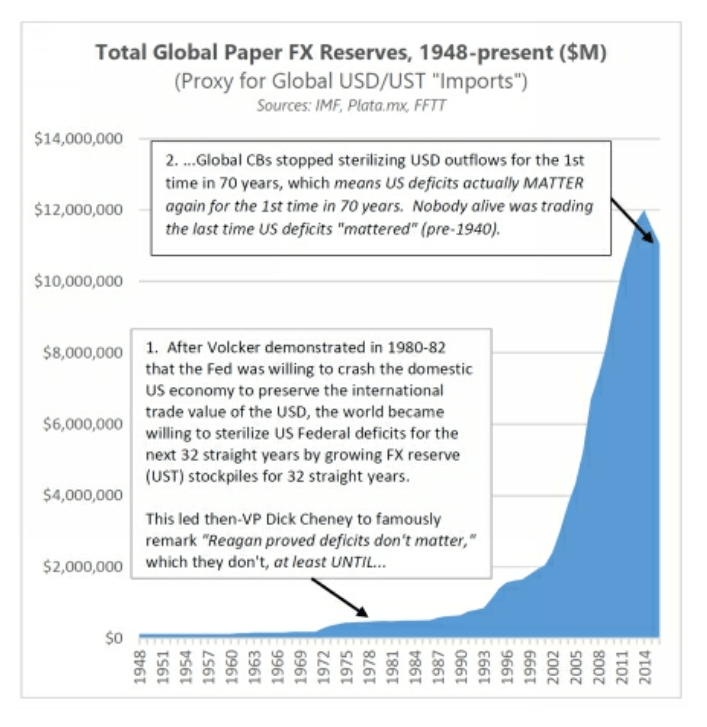

Luke: So, what you’re saying is China led global central banks to begin “choking out” US Federal government spending in the third quarter of 2014 when it stopped increasing FX Reserve (UST) stockpiles, and the US “scrambled to borrow from every source” for two years, driving LIBOR (and the USD) sharply higher, and then in the third quarter of 2016, the first year-over-year drop in US tax receipts represented the US economy basically “tapping out”?

“We have run out of room on monetary policy” – William White, October 2016

I am going to tell a less pleasant story…That is that we get an assumed slowdown or a global recession [Luke: This is the 2016 drop in US tax receipts.] Well, in that case…Efforts would be made to ensure that, somehow, you were forced to buy government bonds or maintain liquidity ratios [Luke: This is what the US has done to US banks, US MMFs, and now tax reform.]

I mention this in passing, but in countries that started off with a very bad fiscal situation [Luke: The US has the worst double deficit in the world], there is a lot of history that indicates that a slowdown, when a country faces a very bad fiscal situation, leads to still more recourse to the central bank and traders, seeing the writing on the wall that central bank financing will eventually lead to inflation. Everybody says: ‘I am out of here.’ There is a currency collapse and hyperinflation. We have seen it many times in history in the worst of the worst-case scenarios.

CHAPTER 3: WHY THE US MAY “BURN DOWN THE WORLD” TO DEFEND THE USD

May 2018

Mr. X: Sure. In a white paper published in late 2016, the BIS, the Central Bankers’ Central Bank, was quite clear. It said, “There may be no winners from a stronger USD.”

Bank/Capital Markets Nexus goes global – BIS, 11/15/16

[Note: And via ZH: The VIX Is Dead: According To The BIS, This Is The New “Fear Indicator”]

“… the 2nd Oil Crisis could be worked through, slowly, but the international financial system could not survive a 3rd Oil Crisis — the inflation would make it impossible to recycle the petrodollars to the oil importing countries with any hope of repayment, trade would crumble, and the system would be brought to its knees.” — BIS Chair Jelle Zijlstra, 1980

The world has now stopped recycling petrodollars to the oil importing countries, which implies one of three things:

- The Fed must raise rates to drive foreign capital into USTs (or crash global markets trying to do so, which would also force a “safety-bid” for USTs/USDs, thereby funding the US government (if for only a brief time);

- The US government must accelerate its efforts in forcing banks, pensions, and MMFs to buy USTs while also pushing even more entitlement costs onto US citizens via ACA, etc.;

- The Fed must renew QE in amounts big enough to fund the US government ($100B +/month or more possibly), or otherwise devalue the USD.

Given options 1-3 above, we are surprised how few on Wall Street even seem to be considering the possibility that the Fed’s rate hike discussions may have nothing to do with the US economy and everything to do with a last-ditch effort by the Fed to try to defend the USD, à la Paul Volcker 1979-1981 (which was obviously not a good time for risk assets).

If Wall Street conventional wisdom does not see the developing US government funding crisis, it cannot possibly consider that the Fed may be hiking rates to defend the USD. Conventional wisdom may be making a grave error — caveat emptor.

Luke: Let’s start with the Fed. What do you think has spooked them?

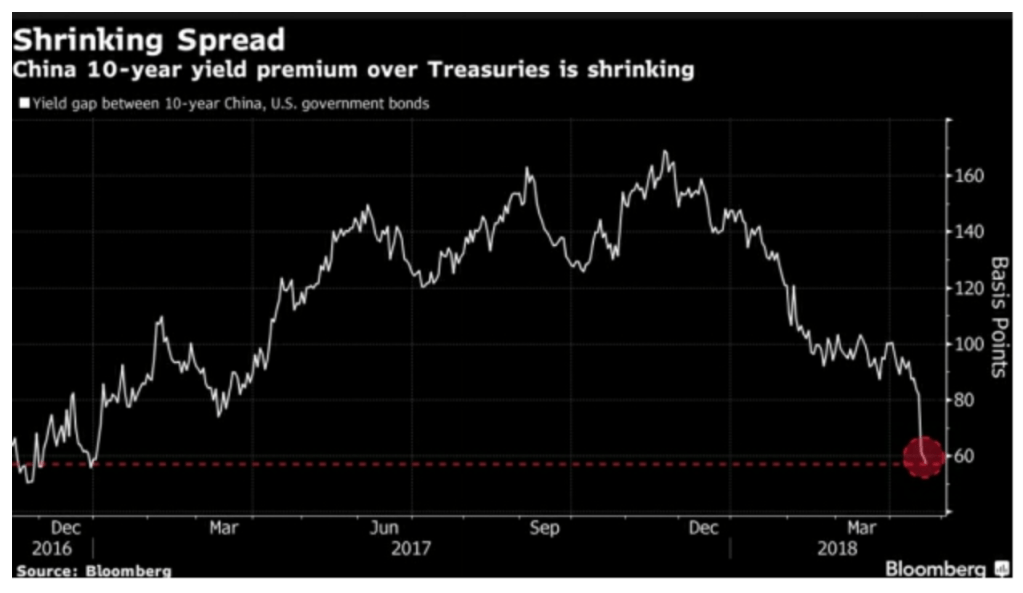

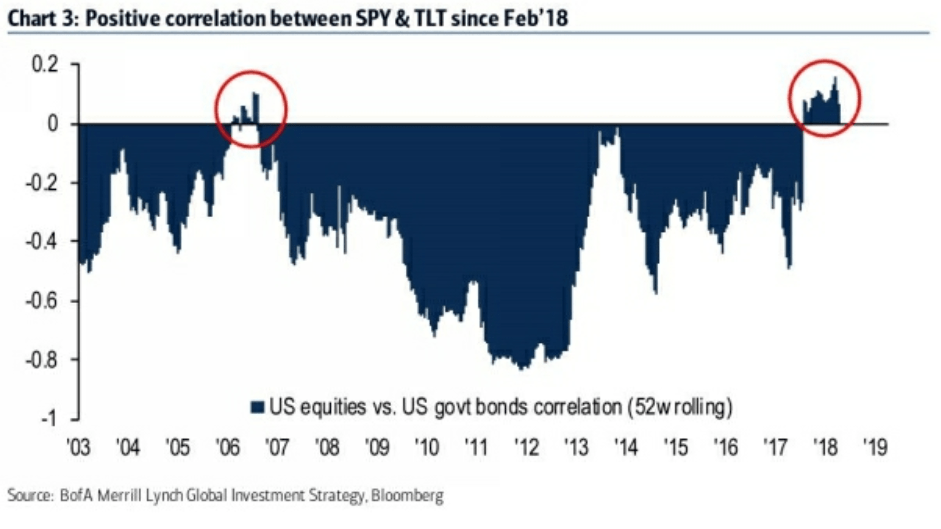

Mr. X: I think two major factors spooked the Fed. First, that the long end of the UST curve sold off in February’s equity market sell-off, one of the fastest 10 percent equity market sell-offs in history. Prior 10 percent equity market sell-offs post-2008 had always resulted in a bid for long-dated USTs (yields down), but in February 2018, investors did not flock into long-dated USTs, which sold off with stocks.

Luke: You think the Fed became fearful that it was beginning to lose control of the long end of the UST curve?

Mr. X: I think it understood that when you have an equity market sell-off and both your currency falls and your sovereign debt yields rise, that is not a good thing.

Luke: Agreed … that’s Emerging Market funding issue-type market action.

Luke: You mentioned a second event that might have spooked the Fed into becoming more hawkish. What was that?

Mr. X: It’s a corollary to UST yields rising in the February sell-off — Chinese government bonds were actually bid in the February market sell-off, even as USTs were sold.

[…]

Mr. X: This is just my opinion, of course, but my sense from watching geopolitical events, plus recent US geopolitical and trade actions, along with the sudden rapid vilification of China in the US and Western prestige media suggests to me that there may be a dawning realization by Western policymakers and assorted other Western establishment elites that not only is China playing by a different set of rules than the West, but the natural outcome of the collision of “China’s rules” and “Western rules” is not a happy outcome for Western power on a relative basis. This is real Game of Thrones-type stuff.

We got China wrong—now what? Washington Post – 2/28/18

Remember how American engagement with China was going to make that communist backwater more like the democratic, capitalist West?

For years, both Republican and Democratic administrations argued that the gravitational pull of U.S.-dominated international institutions, trade flows, even pop culture, would gradually reshape the People’s Republic, resulting in a moderate new China with which the United States and its Asian allies could comfortably coexist.

Well, Chinese President Xi Jinping has just engineered his potential elevation to president for life. This is the latest proof — along with China’s rampant theft of U.S. intellectual property, its military buildup in the South China Sea and Xi’s touting of Chinese-style illiberal state capitalism as “a new option for other countries”— that the powers-that-be in Beijing have their own agenda, impervious to U.S. influence.

The United States needs a long, sober policy rethink. Step one: Remember that friendlier ties with Beijing seemed like a good idea, even a brilliant one, when then-likely presidential candidate Richard M. Nixon first proposed it during the Cold War, also in the pages of Foreign Affairs, half a century ago.

Now it’s evident China has been gaining leverage over the political and economic leaders of the United States and has learned how to make them defer to its norms. If there’s one clear lesson from the past 50 years of U.S. policy toward China, it’s that nothing is inevitable in international politics, or irreversible. From now on, the United States must act accordingly.

The China Reckoning: How Beijing Defied American Expectations Foreign Affairs – 2/13/18

Even those in U.S. policy circles who were skeptical of China’s intentions still shared the underlying belief that U.S. power and hegemony could readily mold China to the United States’ liking.

Nearly half a century since Nixon’s first steps toward rapprochement, the record is increasingly clear that Washington once again put too much faith in its power to shape China’s trajectory. All sides of the policy debate erred: free traders and financiers who foresaw inevitable and increasing openness in China, integrationists who argued that Beijing’s ambitions would be tamed by greater interaction with the international community, and hawks who believed that China’s power would be abated ….

Mr. X: Leading up to the prior articles, I watched as several different senior US government officials explicitly threatened China, and more recently vocalized outright fear of China’s plans:

[Long list articles on China/US Cold War 2.0, among them, this headline:

US Commerce Secretary Ross calls China 2025 plan “frightening” – 4/24/18]

HR McMaster, US national security adviser who oversaw the strategy, this week said China — along with Russia — was a “revisionist power” that was “undermining the international order.”

Luke: Why do you think the tone on China changed the way it has, and changed so rapidly? What “international order” is “revisionist power ” China undermining?

Mr. X: The international order that has the USD-centric system at the center of it, with US officials, therefore, in control of it.

Luke: Some would say that sounds like conspiracy-theory stuff. How is China violating those rules?

Mr. X: By using the flaws of the USD-centric system against itself.

Luke: How are they doing that?

Mr. X: The core underlying mechanics of the USD-centric system are pretty straightforward — the world exports goods to the US, the US exports USDs back to the world, and the world then finances US government deficits by recycling those USDs into USTs, US Agency securities, and the US financial system more broadly.

Luke: Okay, I understand that, so what is China doing in contravention to those “USD-centric system” rules?

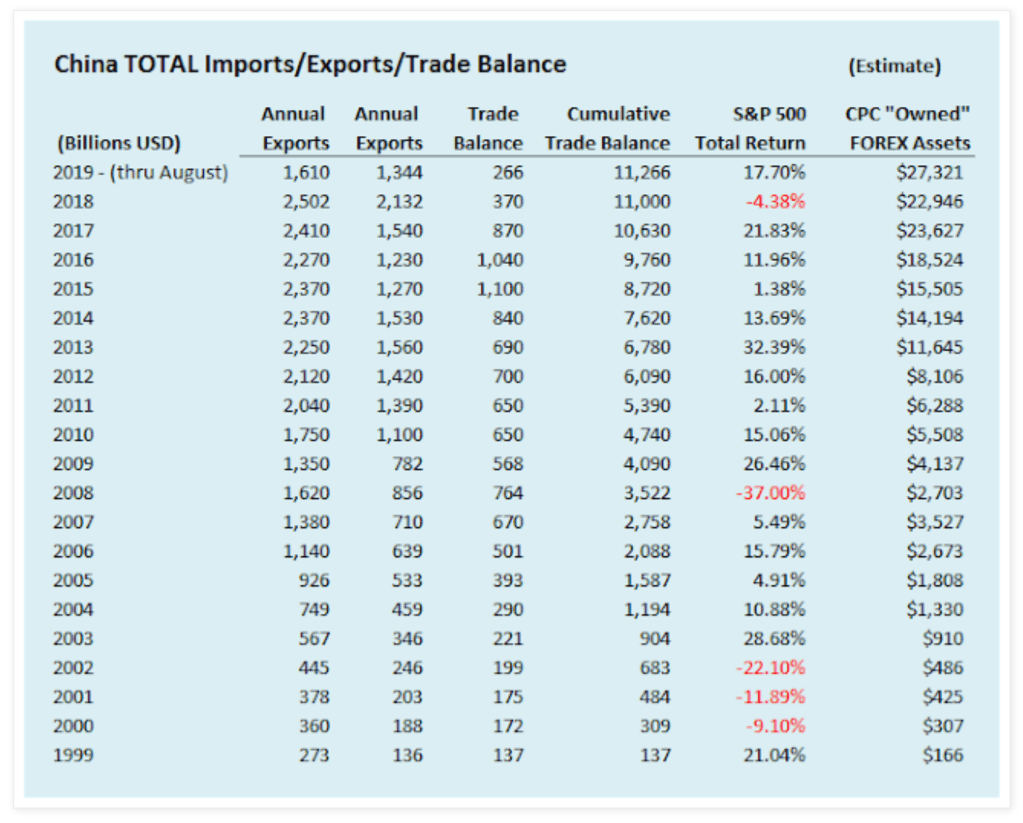

Mr. X: They stopped buying USTs five years ago (after openly announcing they would stop buying USTs, per below):

PBOC says no longer in China’s favor to boost record FX reserves (i.e. UST holdings) – Bloomberg 11/23/18

Luke: I can’t say I blame them. It seems clear that given US Entitlement obligations, there’s no possible way the US can make good on the $100T + it owes in debt and entitlements on a real basis. But if that’s the case, if China’s not funding US deficits anymore as they are supposed to according to the “USD-centric international order, “what are they buying with the USDs they earn from trade?

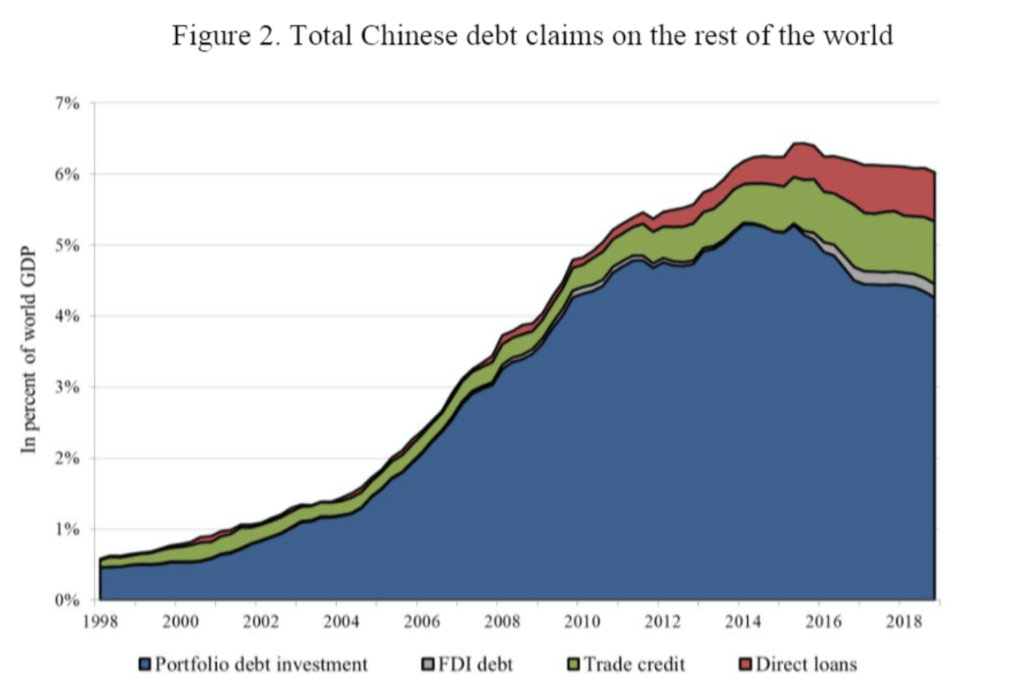

Mr. X: They’ve been acting very deliberately and methodically to “undermine” the “USD-centric international order.” The first step they’ve taken is buying stakes in real assets and companies all over the world. Just Google “China invest or China buying” and read.

Mr. X: By their actions of buying up assets all over the world, China is essentially saying “You keep the USDs. We’ll keep the chemicals, energy, property, mining, software IP, etc. assets.” This is not how it’s supposed to go according to the “USD-centric international order.” However, this has been going on for years. Therefore, it is the more recent second step in the process that is, in my opinion, the more unforgivable sin by China.

Luke: What is this second step that is the “more unforgivable sin” by China?

Mr. X: China is not only exchanging USDs for control of physical assets all over the world, but it is now moving to price those assets in its own currency, in plain sight for even the most willfully-blind US policymaker to see. [Mr. X handed me the following articles.]

China oil futures launch may threaten primacy of USD: UBS – 3/26/18

Shifting just part of global oil trade into the yuan is potentially huge. Oil is the world’s most traded commodity, with an annual trade value of around $14 trillion, roughly equivalent to China’s gross domestic product last year.

Being the biggest buyer of oil, it’s only natural for China to push for the usage of yuan for payment settlement.

[many more headlines on trade in CNY for Russia, Iran & Saudi Arabia]

Luke: Why doesn’t the US do something about it?

Mr. X: What is the US going to do — tell China and, therefore, the world that USDs are not good for anything but USTs? If they did that, the US would all but apply the coup de grace to the USD’s reserve status themselves, especially now that the CNY infrastructure above is nearly in place and China controls such a large amount of physical commodities and assets all over the world because Westerners were so willing to exchange them for USDs… the same USDs the US must emit $100T or more of in coming decades unless the US government is to default on either its external or internal commitments (USTs or entitlements.)

Luke: Can’t we sanction the nations supporting CNY oil and commodity pricing — Russia, China, Iran, or … never mind. We already are, aren’t we?

Mr. X: Indeed. Want to know something else that’s really incredible about all of this?

Luke: What?

Mr. X: Chinese military hardliners were calling for China to do this to the US in 1999, as the US advocated that China be allowed into the WTO and a full two years before China joined the WTO! [Mr. X read to me the following, again emphasizing the key points.]

Chinese general says contain the US by attacking its finances Epoch Times –

“To effectively contain the United States, other countries shall think more about how to cut off the capital flow to the United States while formulating their strategies,” writes Maj. Gen. Qiao Liang, a professor at the People’s Liberation Army (PLA) National Defense University, in an op-ed published in China Military Online, the official mouthpiece of the PLA. “That’s the way to control America’s lifeblood.”

Qiao is one of the leading voices on China’s uses of economic warfare and its broader military strategies using unconventional warfare. In 1999, when Qiao was still a colonel, he co-authored the book “Unrestricted Warfare” with another colonel, Wang Xiangsui.

In “Unrestricted Warfare” Qiao and Wang promoted the use of terrorism, cyberattacks, legal warfare (also called “lawfare”), and economic warfare against the United States. While “Unrestricted Warfare” was published 17 years ago, many of the strategies it proposed can now be seen playing out.

It gets better. Take a read of this.

China increases its gold reserves in order to kill two birds with one stone: Wikileaks, 2011, Unclassified cable from US Beijing Embassy

The China Radio International sponsored newspaper World News Journal (Shijie Xinwenbao) (04/28/11): “According to China’s National Foreign Exchanges Administration China’s gold reserves have recently increased. Currently, the majority of its gold reserves have been located in the U.S. and European countries.

The U.S. and Europe have always suppressed the rising price of gold. They intend to weaken gold’s function as an international reserve currency. They don’t want to see other countries turning to gold reserves instead of the U.S. dollar or Euro. Therefore, suppressing the price of gold is very beneficial for the U.S. in maintaining the U.S. dollar’s role as the international reserve currency.

China’s increased gold reserves will thus act as a model and lead other countries towards reserving more gold. Large gold reserves are also beneficial in promoting the internationalization of the RMB.”

The aforementioned Chinese general was even more explicit in 2015:

The most important event of the 20th century was the decoupling of the dollar from gold on August 15, 1971.

Since then, mankind has really seen the emergence of a financial empire that has brought the entire human race to its financial system. Actually, the so-called establishment of dollar hegemony started from this moment. Today, about 40 years time. And from this day on, we entered a real era of paper money, no precious metal behind the dollar, it fully supported by the government’s credit and profited the world over.

To put it simply: Americans can get physical wealth from all over the world by printing a piece of green paper. There has never been such a thing in human history. In the history of mankind, there are many ways of getting wealth, either by currency exchange, by either gold or silver, or by war, but the cost of the war is enormous. When the dollar turns into a green paper, the cost of making profits in the United States can be extremely low.

By using this method, money is born by the Americans and then exported overseas. As a result, the United States turns itself into a financial empire. The United States has brought the entire world into its financial system.

Many people think that after the decline of the British Empire, the colonial history has basically come to an end. In actual fact, after the United States became a financial empire, it began to implicitly colonize and expand the United States dollar, so that the United States covertly controls the economies of all countries and turns all the countries in the world into its financial colony.

Today we see a lot of sovereign and independent countries, including China, you can have sovereignty, a constitution, a government, but you are [never] separated from the dollar. Everything you end up in various ways is expressed in U.S. dollars and eventually your real wealth enters the United States through endless exchanges with the U.S. dollar.

It can only make money for its own money by allowing international capital to enter the financial pools of the major cities. Then, with the money they earn to cut wool all over the world, Americans are the only living law now. Or what we call in China the American way of living.

In this way, the United States needs a large capital return to support the daily life of the Americans and the U.S. economy. Under such circumstances, [any nation that] blocks the return of capital to the United States is the enemy of the United States. We must understand this matter clearly.

Source: http://www.chuban.cc/dshd/jqjt/201504/t20150415_165579. html – translated, 4/15/15

Mr. X. My guess is that the first step is likely continued escalation of trade tensions… but I am becoming increasingly fearful that the US is now deploying its “nuclear weapon of currency war.”

Luke: Which is what?

Mr. X: The US Fed & Treasury will essentially weaponize the USD to an increasingly extreme degree, essentially destroying the global economy in order to preserve the USD’s role as main reserve currency. If this option is chosen, the bet they are making is that it will drive demand for USDs and USTs higher, breaking global EM markets and commodities first, followed shortly thereafter by the US economy and, ultimately, the US fiscal situation.

Luke: Why would US authorities do such a thing if it will ultimately break the US economy and the US fiscal situation?

Mr. X: Because they believe they are less vulnerable than China and other EMs are to a rising USD and, therefore, the weaponization of the USD will not inflict as great a toll on the US’ own economy before China and other EMs break.

Luke: If you’re even directionally right, this is not a good outlook for risk assets of all stripes, starting with EMs and assets that look like EMs, such as commodities and including US shale producers, no? This is essentially what we have written about twice in the past month — the increasing risk of the Fed “shooting the hostage.”

Luke: How might China end the USD’s reserve currency status as a “nuclear weapon of currency war”?

Mr. X: Remember from earlier that China is increasing gold reserves to “kill two birds with one stone.” China understands gold is anathema to US authorities in particular, and as such, the establishment of a mechanism to settle offshore CNY balances in physical gold settlement in Shanghai, Hong Kong, and Dubai hints at how China, Russia, and others could use gold as a “nuclear weapon of currency war” of their own. As we have discussed before, it appears to my eyes that China has reopened a new “Bretton Woods gold window” at a floating price, through CNY.

It suggests that perhaps some people understand gold may have an important role to play if currency wars further intensify, as it now appears they might; consequently, they are unwilling to sell gold as they normally would, given rising US real rates.

CHAPTER 4: THE US APPEARS TO BE FORCING THE EU INTO AN EXISTENTIAL CHOICE OVER THE NORD STREAM 2 PIPELINE

June 7, 2018

Luke: Weird. Why would the US care whether Germany buys gas from Russia?

Mr. X: Well, one reason seems sure: It is not because the US is concerned with the sanctity of free markets in this case. After all, per The Wall Street Journal article, Russian gas is “at least 20% cheaper” than competing US LNG.

Mr. X: This might explain it. “Subjects under the influence of power, he [Dacher Keltner, a psychology professor at UC Berkeley] found in studies spanning two decades, acted as if they had suffered a traumatic brain injury — becoming more impulsive, less risk-aware, and, crucially, less adept at seeing things from other people’s point of view.”

“Power Causes Brain Damage” – The Atlantic, August 2017

More recently, in the 1950s, the UK’s Lord Ismay famously said that NATO was created to “Keep the Soviet Union out, the Americans in, and the Germans down.”

For America the chief prize is Eurasia…. About 75% of the world’s people live in Eurasia, and most of the world’s physical wealth is there as well, including about 75% of the world’s known energy resources…. The Eurasian Balkans are infinitely more important as a potential economic prize: an enormous concentration of natural gas and oil reserves is located in the region, in addition to important minerals, including gold.

Potentially, the most dangerous scenario would be a grand coalition of China, Russia, and perhaps Iran, an ‘anti-hegemonic’ coalition united not by ideology but by complementary grievances. It would be reminiscent in scale and scope of the challenge posed by the Sino-Soviet bloc, though this time China would likely be the leader and Russia the follower. Averting this contingency, however remote it may be, will require a display of U.S. geostrategic skill on [all] perimeters of Eurasia simultaneously.

From the book The Grand Chessboard by Zbigniew Brzezinski

President Vladimir Putin said on Thursday Russia should aim to sell its oil and gas for roubles globally because the dollar monopoly in energy trade was damaging Russia’s economy.

Putin: It’s “quite possible” Russia could join EU currency zone, create currency that would eclipse the USD Telegraph – 11/26/10

Luke: I have to give it to him — Putin has been very consistent in his stance on the USD.

Mr. X: (smiling) Perhaps his longstanding stance on the problems the USD’s monopoly in energy markets is causing has something to do with how the US and the various USD-centric multi-lateral institutions and officials feel about him, no? Interestingly, I have had at least one senior Western Central Bank official confide to me views very similar to those of Putin on the USD….

Luke: Wait, what? What’d they say?

Mr. X: That the core problem with the world’s economic imbalances is the USD, and more specifically, the USD-centric system.

Luke: Yet they won’t say that publicly?

Mr. X: Such things cannot be said publicly by “serious people” until they are allowed to be said publicly, Luke.

The Russian economy is vulnerable. 80% of Russian exports are in oil, gas, and minerals. People say “well the Europeans will run out of energy. “Well, the Russians will run out of cash before the Europeans run out of energy. And I understand that it is uncomfortable, to have an effect on business ties in this way, but this is one of the few instruments that we have.

Over the long run, you simply want to change the structure of energy dependence, you want to depend more on the North American energy platform, the tremendous bounty of oil and gas that we are finding in North America. You want to have pipelines that don’t go through Ukraine and Russia.

For years, we’ve been trying to get the Europeans interested in different pipeline routes. It’s time to do that. And so some of this is simply acting, and acting as quickly as possible.

Former US Secretary of State Condoleezza Rice’s interview on German television on energy, Russia YouTube – 5/16/14

American media seems to be focused on domestic affairs while astonishing things are going on beyond the borders — and we seem to stand by watching helplessly. The United States position of prominence is eroding. Yesterday, at a summit in Shanghai between China’s President Xi Jinping and Russian President Vladimir Putin a massive 30-year natural gas deal was signed to provide Russian gas to China. The agreement has been under negotiation for years and its fruition is a big deal for energy markets and international politics.

Sitting in Beijing, it could be seen as a financial attack — US Treasury printing tons on [sic] dollars that has the effect of exporting inflation to other countries. We borrow money (by selling treasuries to finance our wars, debt, TARP, etc.) and then pay them off by, in essence, printing dollars. The role of the dollar as base currency is a uniquely powerful lever. It is one that is rarely thought of in terms of national security, but nothing is more important. If we lose it, we will have lost our position as the last super power. Period.

Again from: American Vulnerability — The Dollar: Charles Duelfer – May 22, 2014 (c.f. quotes earlier)

So, what we’re looking at is the possible use by others in the world of our dependence on the dollar to give us so much power that we otherwise would not have….Charles de Gaulle once said it was vicious what we did after the war when we had the world’s reserve currency…and take that power away from us.

And the [US Federal] debt increases enormously the capability [of these other nations] to do that. And the debt is staggering, if you think about it. If you just look at it and understand what the Fed’s been doing in terms of Quantitative Easing and just printing more and more money. The only reason you can do that is because you own the world’s transactional reserve currency.

Lawrence Wilkerson, former Chief of Staff to US Secretary of State Colin Powell – October 8, 2014

Mr. X: It always catches my attention when multiple Washington policy veterans not in official positions (which means they can talk more openly than those still holding official positions) come out and say very similar things about events. These two certainly caught my attention.

Luke: Interesting. Let me take a step back here and ask another bigger-picture question. All I hear in the US media is that Russia is a big threat to world peace and that the US needs to defend the EU against a potential Russian invasion. Isn’t that true?

Mr. X: Let me answer your question with an observation. During the Cold War, a significant percentage of European gold reserves were held in either the US or UK to protect against those gold reserves being captured by the Soviets in case of a USSR invasion of Europe. It stands to reason then that if European Central Bankers still saw Russian invasion as a serious threat, they would keep their gold reserves safe and sound in the US and UK, no?

Luke: Makes sense.

Mr. X: So tell me, what should we infer from the fact that at least three major European Central Banks have repatriated substantial amounts of gold from the US and UK in the past four years, as testified to in these articles?

[list of articles on Germany, Austria and the Netherlands repatriating gold to Europe]

[…]

Mr. X: I have been noticing a quiet groundswell lately of, shall we call it, discontent with the US’ economic bullying, even among nations traditionally among the US’ closest friends and allies. [Here Mr. X paused to laugh.] I mean, once even UK bankers begin referring to you as “You f*cking Americans,” perhaps it’s a sign your government has pressed its weaponization of the USD too far.

[long list of articles of the world complaining about US foreign policy.]

Note: c.f. als this (July 2020):

Luke: Yes, we have always found it curious how both President Obama and Secretary of State Kerry linked Iranian sanctions to the USD’s primary reserve status in a ten-day span in August 2015; it was almost as if they had both gotten the same talking points memo.

Mr. X: Yes, I remember you writing that. Here’s the interesting thing — it almost seems as if the”USD primary reserve status at risk”talking points memo is being distributed more broadly these days.

Luke: What do you mean?

Mr. X: A topic that was once considered the strict purvey of “conspiracy theorists” is suddenly getting a lot of ink from “serious people.” Remember my comment earlier that Certain things are not allowed to be talked about until they are allowed to be talked about?” Perhaps we are at that point in this case, judging by how acceptable such talk has suddenly become.

- US sanction power may be reaching its limit, “response to Iran decision shows global economy won’t be bossed around forever”: Bloomberg – 5/22/18

“Europe & China have banks. One of these days, the US is going to talk the USD right out of its international role.” – Jeff Sachs - The long arm of the USD—how to escape a hegemonic currency: The Economist – May 2018

The more we condition use of the dollar and our financial system on adherence to US foreign policy, the more the risk of migration to other currencies and other financial systems…grows. - America beware: USD supremacy is not forever—under Trump, US increasingly seen as unreliable partner: Financial Times – 5/20/18

China & South Korea are conducting trade using their own currencies rather than relying on the USD as a “vehicle currency”. The logic for denominating in USD virtually all contracts for oil & other commodities is waning. - Donald Trump is jeopardizing the dollar’s supremacy: Financial Times – 5/31/18

The world could be entering an era of multiple reserve currencies, as Barry Eichengreen predicts. This has been typical through most of history. In between the world wars, the dollar and British pound shared the stage with the French franc and the Deutschemark. Today, the rival contenders would be the yuan & euro. The transition could even be a smooth one. But it is also possible that the US will have a massive debt shock, caused by a war, or another 2008-scale financial meltdown. A return to protectionism might do similar damage. At that point, the dollar would cease to be king. - “EU-US-Iran issue is existential for Swift as a global network”: Financial Times – 6/6/18 “Swift’s very survival as a worldwide system for facilitating cross-border payments depends on it resisting such attempts to ‘weaponize’ it for political ends,” said Nicolas Véron, senior fellow at the Peterson Institute for International Economics. “The Europe-US-Iran issue is existential for Swift as a global network,” he said of the action against the company, which is owned by about 2,400 banks and other financial institutions. Luke: Wow…the so-called “prestige financial media” is really warning about the US’ actions, even as the EU, Australia, Japan, India, China, Russia, and others are all warning the US they don’t support unilateral sanctions.

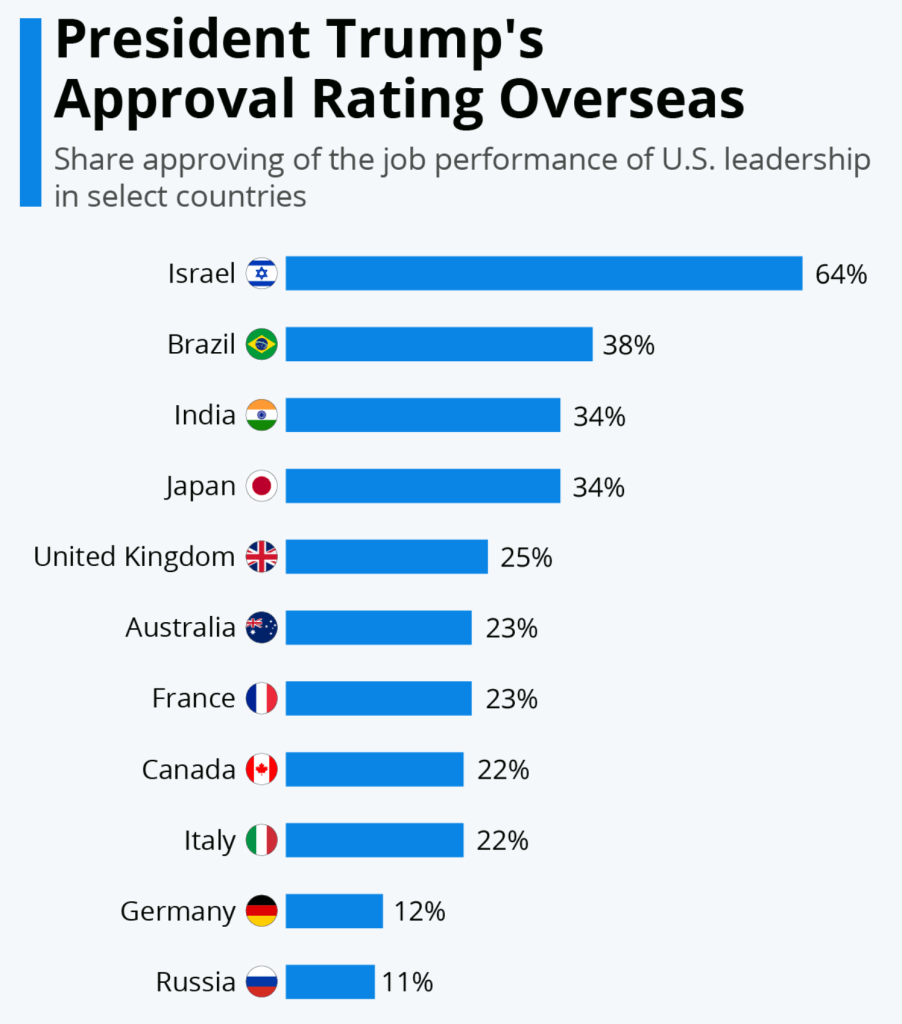

Luke: Wow…the so-called “prestige financial media” is really warning about the US’ actions, even as the EU, Australia, Japan, India, China, Russia, and others are all warning the US they don’t support unilateral sanctions.

[…]

Mr. X: China wants to internationalize CNY through gold; the US does not want this to happen. [Charles Gave of GaveKal] uses the phrase “The Upcoming Monetary War, with Gold as an Arbiter.”

So, you have to understand that the gold price is now a big play between the US and China. For the Chinese currency to be credible, a big rise in the price of gold would help them tremendously. Because they have been buying gold like crazy for the last six or seven years. So, they have huge inventories of gold. And that is what will ultimately lend a lot of credibility to their currency.

On the other hand, the Americans don’t want that de-dollarization because that’s part of their power. And so, what they are trying to do is prevent gold from going up. So, to a certain extent, the price of gold is going to tell you who is going to win in that effort to de-dollarize Asia. If gold goes up, it’s China. If gold goes down, it’s the US.

Charles Gave: Our Industry is NOT prepared for secular inflation! – Macrovoices – 5/10/2018

CHAPTER 5: TRUMP AND “THE MOST POWERFUL BUREAUCRAT IN EU HISTORY” JUST PUT USD-CENTRIC ENERGY/FOREIGN POLICY TENSIONS ON FULL DISPLAY

July 12, 2018

“I think trade is wonderful, but I think energy is a whole different story. I think energy is a much different story than normal trade.”

President Trump has launched a scathing tirade ahead of the NATO summit – 7/11/18

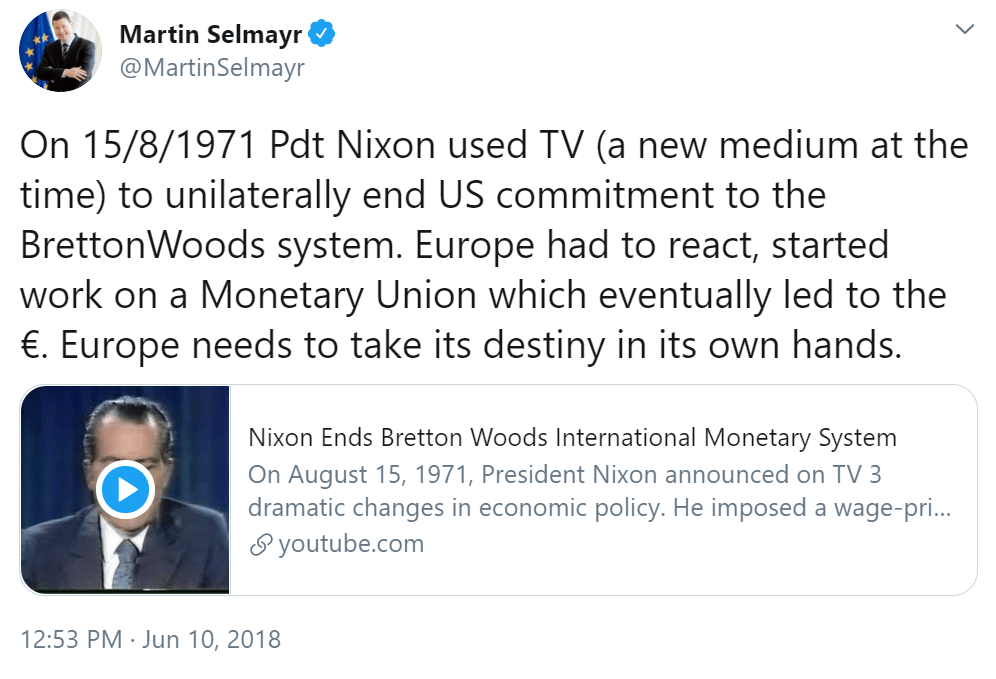

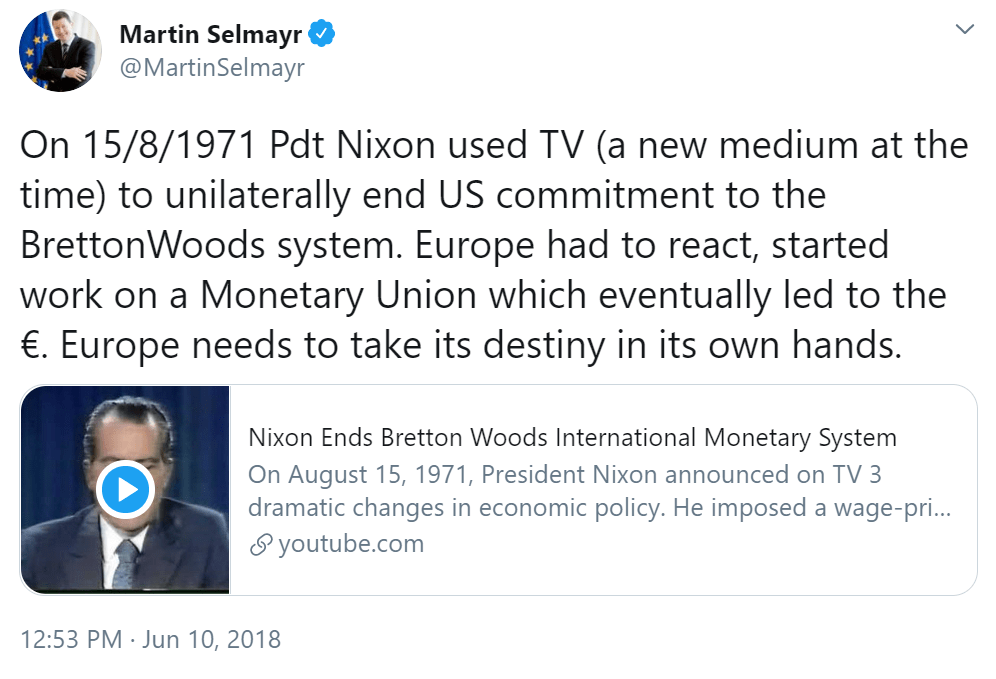

Selmayr’s tweet did not receive nearly the press that Trump’s tirade at German NATO officials did, but in my eyes, it was every bit as significant. The “most powerful bureaucrat in EU history” openly stated that the raison d’etre for the EUR was the US’ unilateral default on the Bretton Woods system (which was followed by the petrodollar), to give Europe the flexibility to “take its destiny in its own hands.”

Curiously, as I have highlighted before, the EUR is not the only currency bloc that sees the US’ unilateral default on the Bretton Woods system as a key moment in history. Chinese general Qiao Liang said something similar in a speech to Chinese Communist Party officials two years ago:

According to the wishes of the Americans, the Bretton Woods system establishes the hegemonic position of the U.S. dollar. But in fact, after more than 20 years of practice, from 1944 to 1971, a full 27 years, it did not really allow Americans to gain hegemony. What blocked the hegemony of the dollar? It is gold.

At that time, few people in the entire world could clearly see this point, including many economists and financial experts. They cannot very clearly point out that the most important incident in the 20th century was not World War I or World War II nor the Soviet Union. The most important event of the 20th century was the decoupling of the dollar from gold on August 15, 1971.

Mr. X: Allow me to put it together. In my view, from these quotes, we can infer that:

- The EU doesn’t like the petrodollar system (or else it never would’ve formed the EUR.)

- China doesn’t like the petrodollar system.

- Russia doesn’t like the petrodollar system.

- The US sees energy trade associated with the petrodollar system as”different from normal trade.”

Not long ago, British scientists [and] the U.S. Geological Survey concluded Europe will not be able to survive without energy supply from Russia, [which means] “The world will not be able to survive if oil and gas from Russia is subtracted from the global balance of energy supply”.

In 1971, US President Richard Nixon closed the ‘gold window’, ending the free exchange of dollars for gold, guaranteed by the US in 1944 at Bretton Woods. In 2014, Russian President Vladimir Putin has reopened the ‘gold window’, without asking Washington’s permission.

— Analyst Dmitry Kalinichenko, 11/23/14

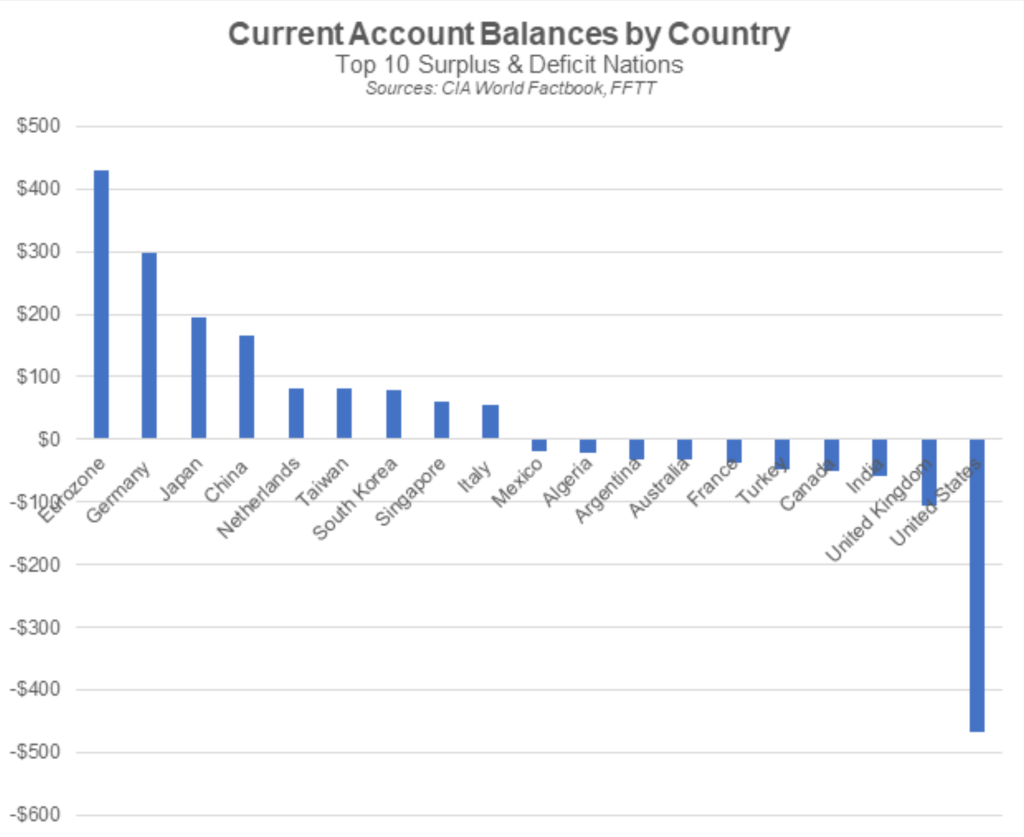

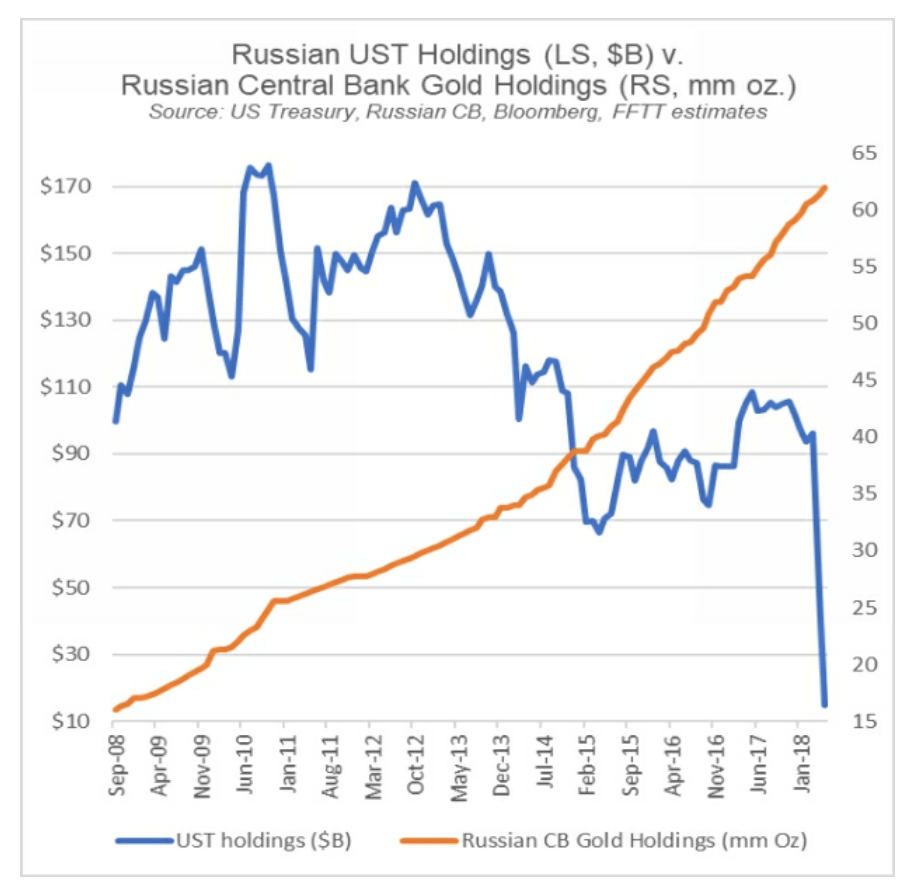

Luke: When we first started talking about this dynamic at FFTT, we sometimes had people laugh at us. However, as time has passed, we have simply showed them this chart. [I passed Mr. X the chart below.] When we do, they stop laughing.

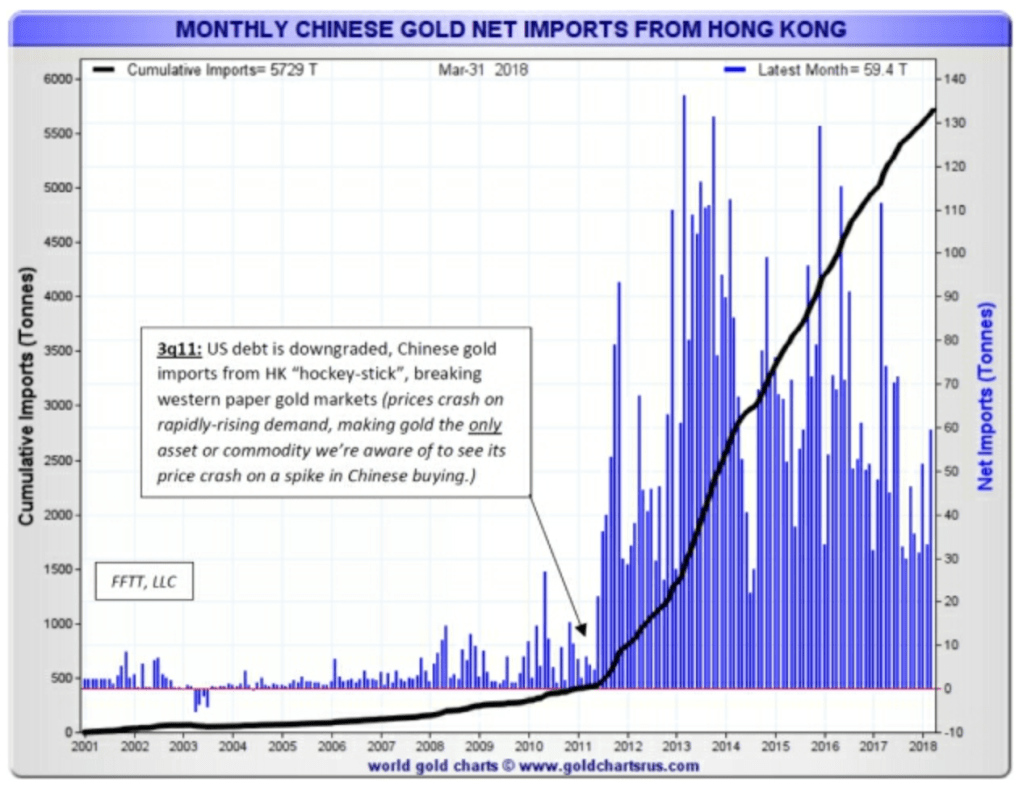

Mr. X: I don’t know who Kalinichenko is, but what he described in 2014 has been happening in spades [describing the chart before]. Whether we look at that Russian gold v. UST chart you just handed me, or what China’s been doing vis-à-vis gold imports:

[Note: gold ever mined in human history: 150-170k tonnes of gold, ~50/50 in jewelry vs investment gold. Current global yearly production: 3.3k]

Also an apt metaphor for all this:

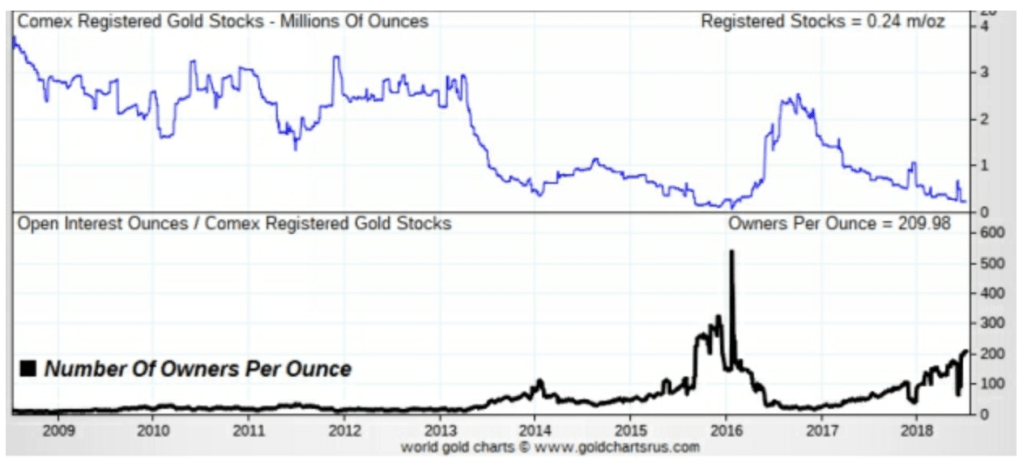

Russia, China, and the EU have been quietly but steadily using energy to weaponize gold against the USD. In this way, all three can resolve the aforementioned energy/USD balance of payments problems, but only if gold is allowed to rise as “energy bids for physical gold.” To date, though, gold has not risen. Why not? As a major physical gold trader told me earlier this year, the answer is “It’s been being papered over.” While there is not great data on physical gold market leverage, the little data that does exist suggests physical gold paper leverage has been steadily rising since 2013:

CHAPTER 6: A US/CHINA TRADE WAR? THE FIRST ROUND’S ALREADY OVER, AND THE US LOST… BUT THE SECOND ROUND IS NOW STARTING

July 19, 2018

And so, given the sudden need to compete with cheap Chinese labor, labor’s share of US economic output unsurprisingly collapsed right along with US manufacturing jobs:

Corporate Profits After Tax in relation to GDP (1950 to today):

Mr. X: The problem for the US system as currently structured is that corporate America and US top executives have been among the biggest beneficiaries of growth in the Chinese economy — first, as a source of low cost labor to bolster margins, and now, more recently, as a sizable portion of US multinational corporate sales.

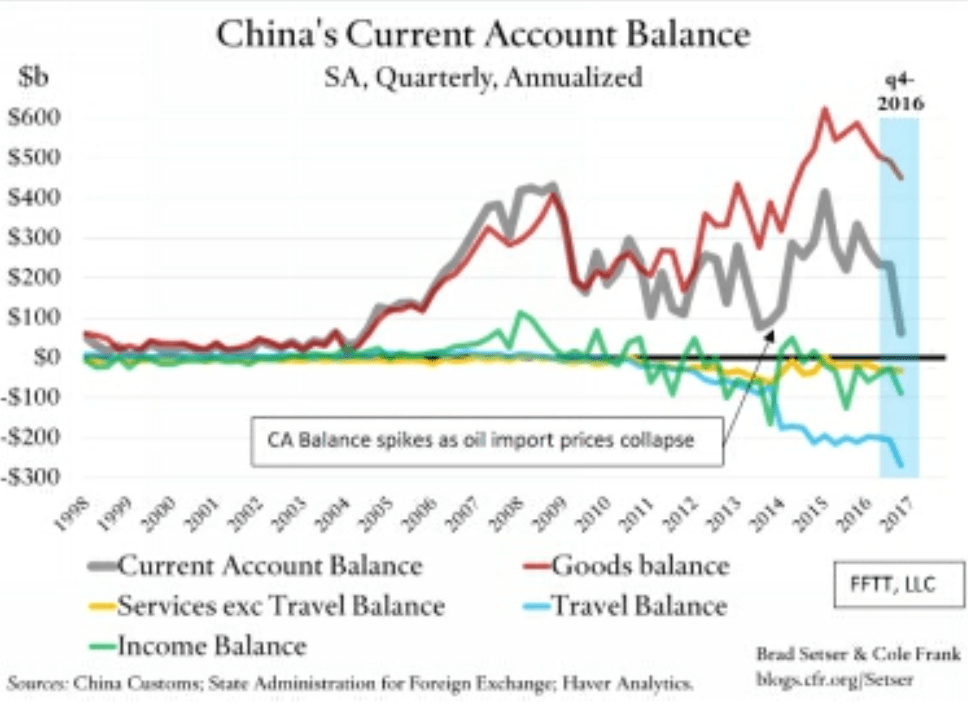

CHAPTER 7: FIRST CURRENT ACCOUNT DEFICIT IN TWENTY-PLUS YEARS MEANS CHINA NO LONGER HAS THE LUXURY OF “PLAYING THE LONG GAME”

August 2, 2018

Mr. X: It was driven in no small part by a rapidly-growing services deficit, which is rising largely due to rapidly-growing Chinese tourism.

China’s energy consumption (and likely total commodity consumption) is growing strongly (energy up 6.8 percent year-over-year according to Bloomberg data) [below].

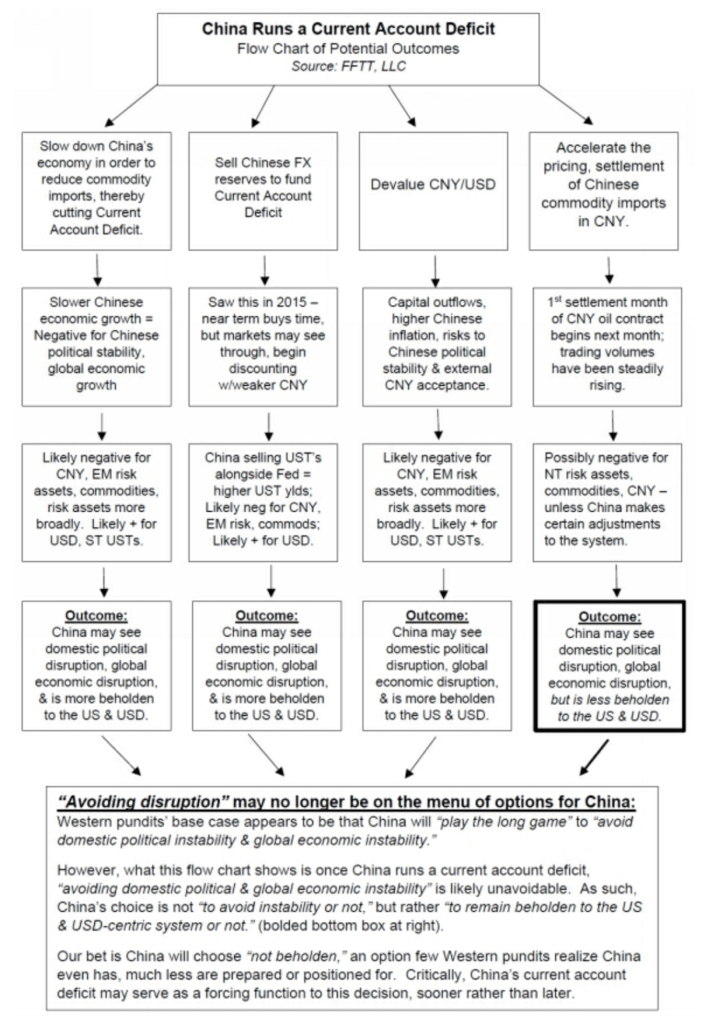

Mr. X: China running a sustained current account deficit could be problematic to the Chinese yuan and, therefore, to Chinese authorities. However, this implies that unless China either…

- Limits Chinese outbound tourism (which would likely run counter to domestic Chinese political goals), or

- Slashes commodity imports further (likely limiting economic growth and again running counter to domestic Chinese political goals),

…then China’s current account deficit is likely to continue to worsen from here. This decision tree flow chart highlights why a structural Chinese current account deficit could be problematic, and the steps China could take to combat it.

Mr. X: In light of the chart below, it is noteworthy that the first settlement month of China’s CNY oil contract is next month—September—just as China’s current account deficit issue is coming to a head.

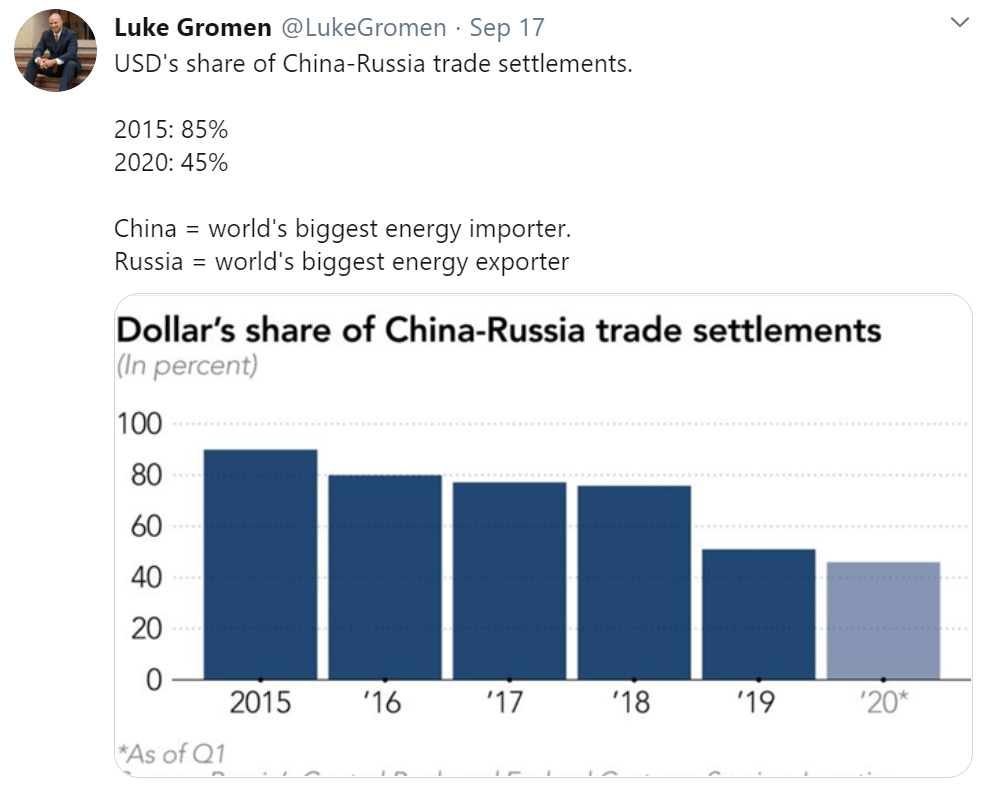

Note: see also this recent chart (Sept. 2020):

Mr. X: The Wall Street Journal has been noticing this correlation between gold and Chinese yuan since June 2017.

Gold priced in Chinese yuan has been quite stable over the past 6-9 months.

CHAPTER 8: NEGATIVE FX-HEDGED UST YIELDS FOR FOREIGN INVESTORS = RISK OFF, USD UP, RATES UP UNTIL USD IS DEVALUED

October 18, 2018

Foreigners can no longer underwrite US economic expansion: Financial Times – 10/12/18

Mr. X: The title was quite direct—“Foreigners can no longer underwrite US economic expansion”—and its subtitle was perhaps even more so: “America’s’ ‘free lunch’ is over as regulators urge reduction in swaps exposure.”

You know those bells that are supposed to never ring to signal a turn in the market? Well, they started ringing on September 27 and 28. On that Thursday and Friday, just before the end of the third quarter, the interbank market’s cross-currency “basis swap” for euros to US dollars rose by 30 basis points. In the same period, the cost of yen-dollar basis swaps went up by 46 basis points. That was the end of foreigners paying for the US’s economic expansion. It also probably marked the end of the housing recovery.

The effect of those changes in the basis swap rates was to make it uneconomic for European or Japanese investors to buy US Treasury bonds and hedge away the currency risk. That such trades were possible would appear to violate the “no-arbitrage principle” of financial economics, but then America usually gets a free lunch from the rest of the world.

All this made it possible for non-US institutions to hold large bond positions that paid a positive rate of interest without incurring any foreign exchange risk. This may appear to be a sort of financial magic, but the foreign exchange risk did not go away. It just continued to grow as an irradiated part of the banks’ derivatives book that had been hidden in plain sight.

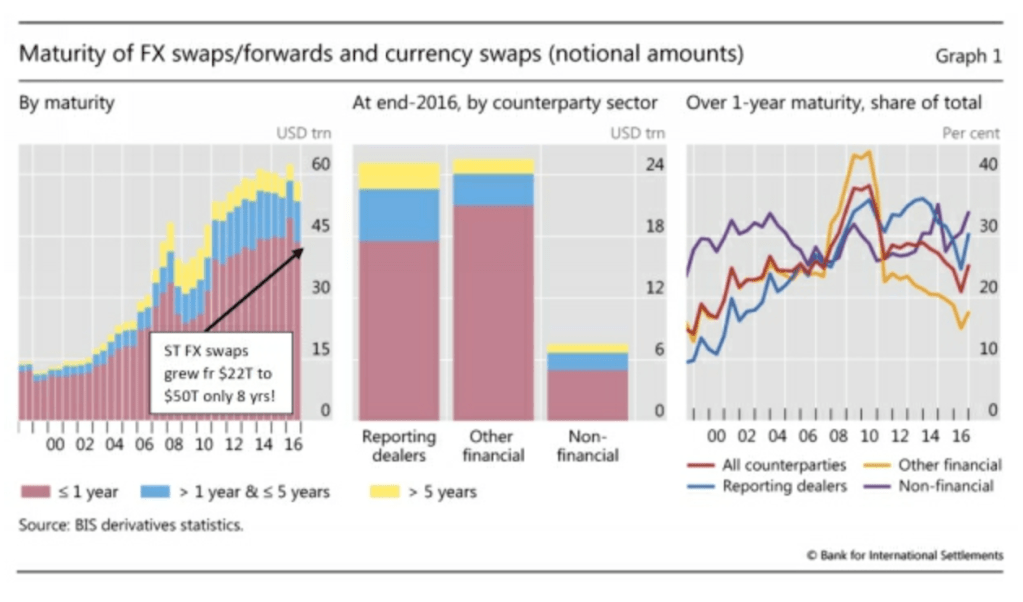

Luke: “… a sort of financial magic” that “continued to grow as an irradiated part of the banks’ derivatives book. “How fast have FX swaps grown?

Mr. X: quite rapidly. FX swaps with maturities of less than one year have grown from $ 22T to $ 50T (notional) in only eight years!

Mr. X: Dizard discusses this BIS report in the Financial Times article, noting that they identified a problem but hesitated to really “call out” the problem in plain language:

By September last year, though, central bank researchers had estimated what they called “the missing foreign debt” that had been financing the relatively strong US recovery. According to a special report by the Bank for International Settlements, the “missing” debt was in excess of the $10.7tn in cash market valuations. The BIS estimated in 2016 that “the missing debt amounts to some $13-$14tn but the implications for financial stability are quite subtle and require an assessment of both currency and maturity mismatches”.

Luke: “The missing debt amounts to some $13-14 trillion but the implications for financial stability are quite subtle”? Classic central bank-speak…

Mr. X: For sure. Luckily, Dizard not only translated the BIS’ “central bank-speak” into plain English…

To sum up those “subtle implications”: the US had borrowed an extra $14tn or so, and the currency risk assumed by the foreigners lending this money had been principally covered by the US banking system, which had underestimated how dangerous this could be.

Luke: Per the BIS, FX swaps with maturities of less than one year are the vast majority (more than 75 percent) of the total FX swaps outstanding.

Mr. X: So, tell me Luke, as a large percentage of both their FX swaps and their UST holdings mature over the next twelve months, why would an existing foreign private sector holder of USTs “roll” their UST holdings if the FX-hedged UST yield is currently nominally negative versus their own domestic bonds or other nations’ bonds with positive yields?

Luke: So, how do you think this is going to play out?

Mr. X: I think the answer to your question has three parts. First, given that the US has $7-8 trillion in USTs it needs to roll in the next twelve months, some portion of which foreign investors may not be interested in rolling at current cross-currency basis swap levels, I would say it is likely going to play out surprisingly quickly, because $7-8 trillion is just an enormous sum of money.

Secondly, I think UST auctions may get surprisingly sloppy for that same reason, putting pressure on the US economy, and possibly on risk assets in the very near term. Thirdly, ultimately the urgency of my first and second points provide valuable context to this passage from Poszar’s November 2016 report, paying particular attention to the final paragraph below. [He read to me, emphasizing the key points as he did so.]

The U.S.’s exorbitant privilege — its ability to borrow in its own currency anywhere in the world thanks to a vast and deep Eurodollar market — is waning. The first throw of sand at the gears of the global Eurodollar market was the adoption of Basel III which imposed liquidity requirements on a system born out of banks’ desire to avoid reserve requirements in the first place.

Basel III and money fund reform are turning the exorbitant privilege into an existential trilemma that’s usually a problem for EM central banks with pegs to the dollar, rather than the Fed at the center of the dollar-based financial order.

According to the Fed’s newfound trilemma, it is impossible to have constraints on bank balance sheets (restraining capital mobility in global money markets), a par exchange rate between onshore dollars and Eurodollars, and a domestically oriented monetary policy mandate. Something will have to give.

It’s either the cross-currency basis, the foreign exchange value of the dollar or the hiking cycle.

[Note: More on all this via ZH and Michael Every:

- BIS Finds Global Debt May Be Underreported By $14 Trillion

- “Down The Rabbit Hole” – The Eurodollar Market Is The Matrix Behind It All

]

[…]

Mr. X: I’d also add that Secretary of the Treasury Jack Lew’s Congressional testimony around the debt ceiling about what happens if it gets harder for the US to roll USTs might be instructive to re-highlight. [Mr. X read the following to me.]

In testimony before the Senate Finance Committee in October 2013, Lew explained why he wanted the Congress to agree to increase the federal debt limit — and why the Treasury has no choice but to constantly issue new debt. “Every week we roll over approximately $100 billion in U.S. bills,” Lew told the committee. “If U.S. bondholders decided that they wanted to be repaid rather than continuing to roll over their investments, we could unexpectedly dissipate our entire cash balance.” “There is no plan other than raising the debt limit that permits us to meet all of our obligations,” Lew said. “Let me remind everyone,” Lew said, “principal on the debt is not something we pay out of our cash flow of revenues. Principal on the debt is something that is a function of the markets rolling over.”

Transcript of Jack Lew’s testimony on debt ceiling: – Washington Post, 10/10/13

[Or as MMT would say, “we just print it”]

CHAPTER 9: VOLCKER’S “HELL OF A MESS IN EVERY DIRECTION” COMMENT MAY HINT AT BIGGEST MACRO RULE CHANGE IN FORTY-SEVEN YEARS

November 8, 2018

“…the 1960s saw a growing disequilibrium in international payments, consequent on the deficit in the US balance of payments. The dollar became overvalued and the US found it increasingly difficult to meet its obligations to convert the dollar (into gold.) It is my firm conviction that a devaluation of the dollar combined with a substantial increase in the price of gold (as provided for in Article IV of the then Articles of Agreement of the International Monetary Fund) would have meant a real improvement of the situation.

– BIS Chair Jelle Zijlstra, 1981

Mr. X: In the time described in this quote, the US was running balance of payments deficits because of President Johnson’s “Guns and Butter” programs. Zijlstra (a Dutch banker who demanded gold back from the US in the late 1960s and who went on to be the head of the BIS) believed the best solution to balancing US deficits in the late 1960s would have been a devaluation of the USD.

Of course, as former Greek Finance Minister Yanis Varoufakis describes on this sheet of paper, the US had other ideas. Paul Volcker came up with a brilliant plan: If the US couldn’t handle its own surpluses anymore, the US would structure a system that allowed it to handle other countries’ surpluses:

What did the Americans do when they realized that they had a deficit situation that was now actually growing? They did something absolutely astonishingly remarkable: They decided that the solution to the deficit problem was to enhance their deficits… to make them grow, and to make them grow at an increasing rate. Now that is an astonishing conception. How am I backing up this story?

Well, Paul Volcker as a young man worked for Henry Kissinger before Kissinger became the foreign minister, Secretary of State for the United States (when he was still National Security Advisor). Volcker was working for him. Kissinger asked Volcker, who was a young banker, to come up with an idea as to how could American hegemony be expanded when the deficit is increasing. Volcker wrote a three-page report, which actually I have read. It was very difficult to get. You could not find it anywhere, even on the internet. I have it in a manuscript form and it was given to me by a friend, an American, some time ago; it is perhaps the most remarkable statement of the 20th century. Well, I am exaggerating, but you know what I mean.

In it, Volcker said, well, if we can’t remain hegemonic — that was the word he used — no, that is not a left-wing text, it’s Volcker. If we can’t remain hegemonic by — “handling” was the word he used — our surpluses, we should do it by handling other people’s surpluses. And that’s the Global Minotaur. Effectively what America did was this: We don’t have a surplus anymore and so we can’t recycle it. But we can recycle everybody else’s surpluses and retain our hegemonic position through that.

And it is the very first time in human economic history or history in general that an empire is expanding its realm and its power and its strength and vitality by expanding its deficits. Usually when an empire has a deficit, it is the beginning of its decline. Not in the case of the United States.

Former Greek Finance Minister Yanis Varoufakis on the Volcker Study: YouTube – Group plan, 2014

Mr. X: While Volcker’s plan was a masterstroke for certain interests in the US (the US government and US finance sectors in particular), other parts of the world were less sanguine about Volcker’s plan. For example, here’s what a man once called “the most powerful bureaucrat in Brussels “and” the true leader of the EU, “Martin Selmayr, wrote about what was transpiring around the time of Volcker’s move. [Same tweet as earlier]

Mr. X: The Europeans apparently didn’t like Volcker’s plan because, according to Selmayr, they “started work on a Monetary Union which eventually led to the EUR.” Guess what happened once the EUR was launched?

Mr. X: Luke, as you’ve noted before, shortly after China stopped growing UST stockpiles, the US created a patchwork of demand for USTs, first regulating US banks into buying more USTs via “High Quality Liquid Asset (HQLA)” regulations…

…and then regulating US money market funds into buying more USTs via Money Market Fund (MMF) Reforms….

Luke: Yes, we’ve written about this a number of times — these dynamics were eerily similar to Emerging Markets regulating the domestic sector into financing the government once external sources of financing were lost.

[…]

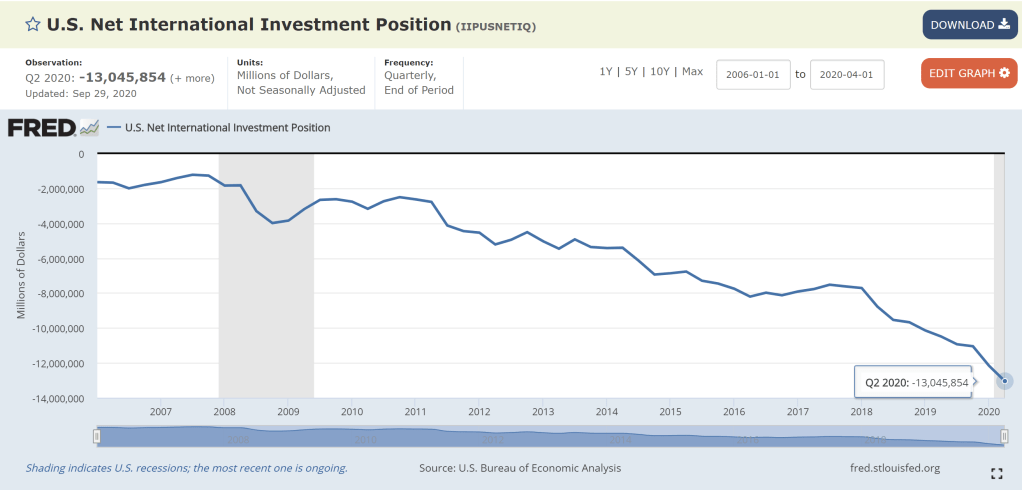

Mr. X: Besides slowing the US economy, US efforts to reduce US deficits and fund those deficits internally for the first time in seventy years worked well… until the third quarter of 2016, when the post-third quarter of 2014 crowding out of the US private sector drove the first widening of the US deficit as a percentage of the GDP since 2009. This was the first key tipping point. In plain English, US attempts to finance its own deficit for the first time in seventy years were now resulting in a widening of the US deficit! This was a “Greece problem with US characteristics.”

The third quarter of 2016 was the first major tipping point in the process of US deficits mattering for the first time in seventy years. In my view, the next major tipping point in this process came earlier this year, and it is shown in this chart. [He passed me the chart below.] USTs began selling off in major equity market risk-offs in 2018 in the most sustained manner we’ve seen in at least twenty years….

Mr. X: (smiling) Yes, the US needs a new “sugar daddy”— but using the “China financing 10-50% of US deficits from 2002-11” as a guide, this implies another nation running $ 100-$500B/year in surpluses with the US in coming years — $ 100-$500B per year is 10-50 percent of $1T deficits projected by US Congressional Budget Office (CBO).

Who is going to do that? India? Unlikely. Africa? Possible… but this would require either massive price inflation of African commodity exports to the US or the offshoring of the US manufacturing base to Africa. The problem with the latter solution, of course, is that a quorum of the US’ manufacturing base already resides in China.

What commodities can Africa export to the US at inflated-enough prices that would drive $100-500B per year of surpluses to fund UST buying? Could African commodities be inflated that much without crashing the global economy as EMs find themselves unable to afford African commodity imports? The answer to both questions is unclear to me.

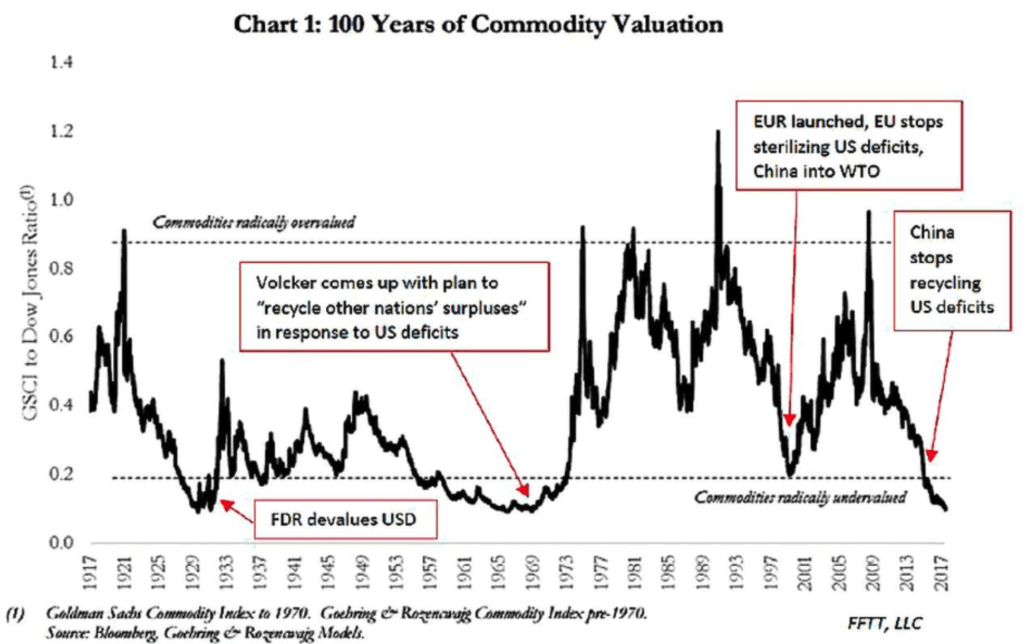

This chart provides a guide of what happened to commodities, and by extension, the USD the last two times the US found itself in this situation.

Luke: So, what is your conclusion for all of this?

Mr. X: The conclusion is we appear to be in a similar spot to where we were in 1970 and 1999… commodities at/near 100-year lows relative to financial assets and the USD at/near recent highs… except this time we have worse demographics, a worse deficit position, a worse debt position, and no obvious successor to be our next deficit-recycling “sugar daddy.”

This implies the US needs to do one of two things, ASAP:

- Find a new country/region running large surpluses that we can “handle.”

- Get the EU to break up so that Germany will be able to recycle US surpluses once again.

However, if the US cannot do one of those two things very soon, there is only one release valve: The USD, as the Fed is forced to become the US’ new “sugar daddy,” and far sooner than most think. [The Fed will] effectively becoming the financier of last resort, and eventually financier of first resort for US government deficits.

Luke: What does that mean in plain English?

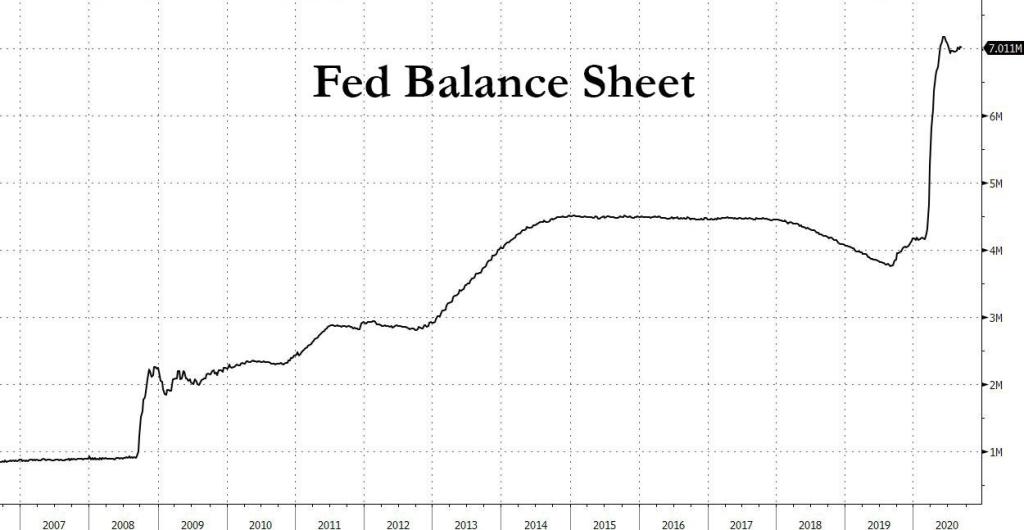

Mr. X: What it means in plain English is that I think it is highly likely we will see the Fed’s balance sheet begin to expand aggressively at some point in 2019.

[Note: Quick check-in Sept 2020:

via Bloomberg via ZH: Fed To Continue “At Least” $120BN In Monthly QE To “Support Flow Of Credit To Households”

]

CHAPTER 10: IF BIG DEFICITS + TIGHTER MONETARY POLICY = USD+, THEN BIG DEFICITS + LOOSER MONETARY POLICY = ______?

December 13, 2018

Mr. X: Because US economic financialization levels mean US tax receipts will fall as rates rise — indeed, US tax receipts are already falling year over year, after only what? Two tiny interest rate hikes and a 100bp increase in LIBOR in twelve months?

As this occurs, it will lead to rising US funding needs, which with US Federal debt levels above 100 percent of GDP, higher rates, and a continued foreign official creditor UST buyers’ strike, could kick off a US BoP crisis.

Luke: While we did not get the USD devaluation we discussed in January 2017, we did get the biggest decline in the USD in decades in 2017, down 12 percent, when virtually everyone thought the USD would rise in 2017.

[long list of stuff crashing on US markets]

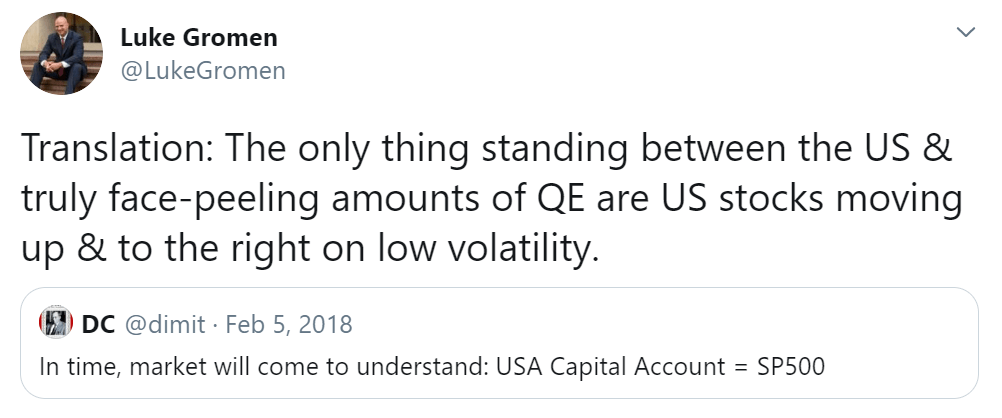

Mr. X: Because the US began having to fund a much greater percentage of its own deficits, which it can do, but not with US equity markets priced anywhere near where they were at the end of September. The US’ deficits went from crowding out the world to crowding out the US economy. As long as FX-hedged UST yields stay negative, US risk markets will likely remain under pressure. It’s fascinating….

EPILOGUE: “THE MOST IMPORTANT CHART TO CONSIDER FOR 2019”

January 3, 2019

There were essentially only 2 ways to restore the past balance between the value of gold reserves & the total money supply. One was to put the whole process of inflation into reverse & deflate the monetary bubble by actually contracting the amount of currency in circulation … but it was painful. It inescapably involved a period of dramatically tight credit & high interest rates. The alternative was to accept that past mistakes were now irreversible, & reestablish monetary balance with a sweep of the pen by reducing the value of the domestic currency in terms of gold (devalue.) The US & UK took the route of deflation; Germany & France that of devaluation/inflation.

— Liaquat Ahamed, Lords of Finance: The Bankers Who Broke the World, p. 156

Here’s how it is playing out this time, using your transcript of our conversation we had in May of last year: I am becoming increasingly fearful that the US is now deploying its “nuclear weapon” of currency war. The US Fed & Treasury will essentially weaponize the USD to an increasingly extreme degree, essentially destroying the global economy in order to preserve the USD’s role as main reserve currency. If this option is chosen, the bet they are making is that it will drive demand for USDs and USTs higher, breaking global EM markets and commodities first, followed shortly thereafter by the US economy and, ultimately, the US fiscal situation.

— Mr. X, 5/3/18

And here is my point in highlighting these quotes to you — in my opinion, here’s the choice the Fed will likely face before the end of 2019:

Von Havenstein faced a real dilemma. Were he to refuse to print the money necessary to finance the deficit, he risked causing a sharp rise in interest rates as the government scrambled to borrow from every source. The mass unemployment that would ensue, he believed, would bring on a domestic economic & political crisis, which in Germany’s current fragile state might precipitate a real political convulsion. As the prominent Hamburg banker Max Warburg, a member of the Reichsbank’s board of directors, put it, the dilemma was ‘whether one wished to stop the inflation & trigger the revolution,’ or continue to print money. Loyal servant of the state that he was, Von Havenstein had no wish to destroy the last vestiges of the old order.

— Liaquat Ahamed, Lords of Finance: The Bankers Who Broke the World, p. 125

Further notes:

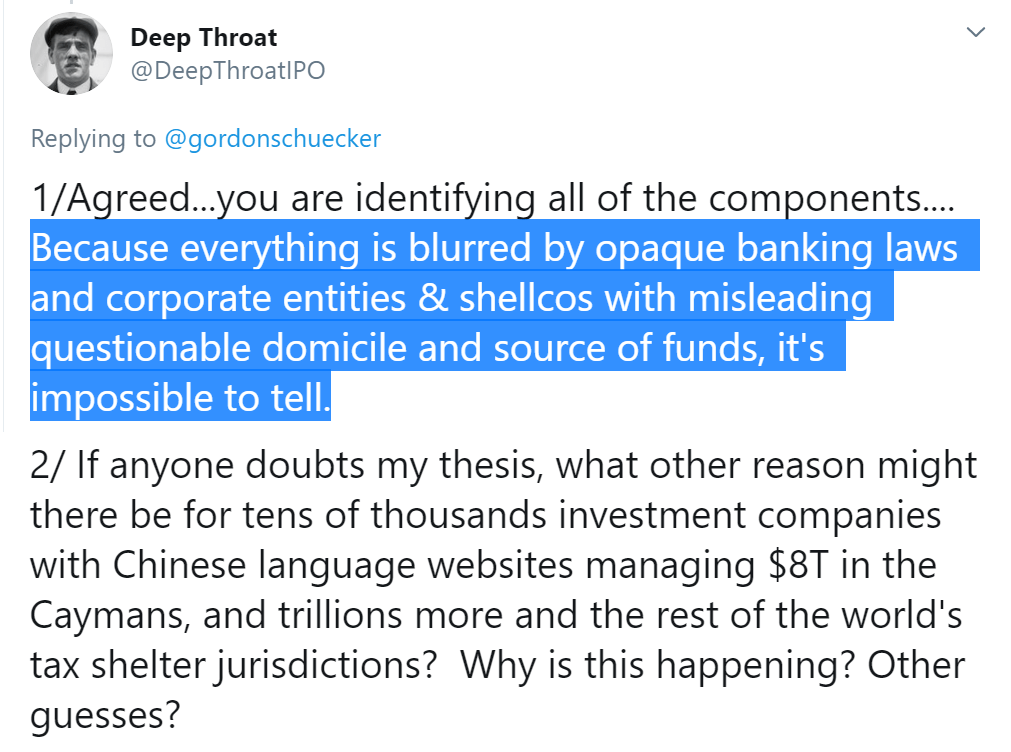

The global portfolio of China has been estimated at ~$30T by @DT_IPO in for example this post:

The details are of course very difficult to get:

According to these findings here, the number is only ~$5T.

If Chinese assets are distributed in a similar fashion as in the US…

…many trillions might simply be in the hands of wealthy Chinese living abroad without any weaponized behavior behind it?

Yet there is of course the fact that the Chinese economy is a ginormous Ponzi-Scheme:

With an epic housing bubble at the heart of it:

A Look Inside The $52 Trillion Bubble That Has “Hijacked China’s Economy

Though a totalitarian state may or may not have more flexibility in dealing with any bubble burst.

That said, any Chinese master plan is likely not mature enough to be implementable yet. But if it were, it could look something like this:

The Stealth Nationalization of America’s Banks…..an “Economic-Whodunit-Thriller-Novella”

Recalling [27], we are probably going to find out soon. C.f. also:

China To “Gradually” Sell 20% Of Its US Treasury Holdings, May Dump It All In Case Of “Military Conflict”: State Media

In any case, we live in interesting times.

P.S.: How some think the system could be restarted:

Central Bank Issues Stunning Warning: “If The Entire System Collapses, Gold Will Be Needed To Start Over”

P.S.S.: Some more charts