Arguably the most undervalued asset on Wall Street are history books.

— Luke Gromen

I really enjoy following Luke on Twitter. Great to read his thesis articulated succinctly, including some great quotes.

The book could have started with this question:

Hint:

Binge spendings, enormous debt financed by countries it is at war in various forms, more wars with others. What could go wrong? The road ahead for the US dollar and why things might move quickly soon.

I very much recommend this brief book, especially to people with limited daily finance and geopolitical exposure. In the meantime, here are my favorite quotes. (C.f. also my twitter thread.)

***

Abbreviations:

Fed: Federal Reserve (US Central Bank)

BIS: Bank of International Settlement (the central bank of central banks)

BoP: Balance of Payments

UST: US treasury bonds

USD: US dollar

CNY: Chinese Yuan (Chinese currency)

WTO: World Trade Organization

FX: Foreign Exchange

EM: “Emerging Markets”

***

Somebody once said, “Events can go from impossible to inevitable without ever stopping at improbable.”

I have always been surprised how little most US citizens, and investment professionals specifically, understand that much of the style and standard of living that most US citizens have grown accustomed to is a function of the petrodollar system.

Pricing oil in yuan? Hasn’t selling or buying oil in any currency that is not dollars historically been a big geopolitical no-no? To ask more directly, didn’t changing the pricing of his oil to euros contribute to Saddam’s downfall?

Luke: So if that is the case, and Russia and Iran began selling oil to China in yuan instead of dollars, why hasn’t the United States reacted?

Mr. X: What makes you say the United States hasn’t reacted? Since shortly before or shortly after the so-called “Holy Grail” energy deals were discussed and signed between Russia and China in May 2014 (that were later shown to be yuan oil deals), there has been a spontaneous outbreak of open war in Russia’s client state Syria, a color revolution in Ukraine, sanctions on Russia and Iran, and heightened tensions with China…. That strikes me as quite an incredible string of coincidences.

As noted by former senior US Treasury official Juan Zarate in his 2013 book Treasury’s War:

The dollar serves as the global reserve currency and the currency of choice for international trade, and New York has remained a core financial capital and hub for dollar-clearing transactions. With this concentration of financial and commercial power comes the ability to wield access to American markets, American banks, and American dollars as financial weapons.

In 2015, the NY COMEX gold exchange settled less than fifty tons of physical gold all year. In contrast, on average the Shanghai Gold Exchange settled over fifty tons of physical gold every single week of 2015. If you want physical gold, which exchange is more credible?

Paper gold is, in extremis, merely an obligation of a Too-Big-To-Fail (TBTF) bullion bank, which was shown in 2008 to be an obligation of the US government in extremis. In other words, paper gold = USDs. If you are going to take paper gold as trade settlement, you might as well just stick with USTs.

And China probably didn’t do anything because by virtue of getting into the WTO in late 2001, the Americans essentially began trading large remaining chunks of the US industrial base for steady Chinese purchases of USTs, which was something the Americans desperately needed after the formation of the EUR because the Europeans basically stopped incrementally funding the US government (buying USTs) after the EUR’s launch in 1999.

Luke: Okay, so, in light of what Zijlstra said so long ago and what happened in 2008, you mentioned once the system was stabilized, there was grumbling internationally about the system. What did that grumbling say? What needed to change?

Mr. X: Not too long after the 2008 crisis, I was visiting the United States when I saw a protestor on TV somewhere holding a sign that said, “No more capitalism for the poor and socialism for the rich.” I doubt that protestor realized it, but that sentiment was being echoed with the world’s creditor nations, many of which were Emerging Markets.

Judging by the triumphalism in US financial media about the Fed’s role in saving the financial system, the Washington Consensus and neoliberal economists don’t seem to realize it, but their policies were totally discredited after 2008.

Luke: Why?

Mr. X: Because the policies they implemented in the United States in response to the crisis were nothing in severity like those implemented in Russia in the mid-1990s, in Southeast Asia in the late 1990s, or in Argentina in the early 2000s. It was, like the protestor’s sign said, “Capitalism for the poor (EM/creditor economies) and socialism for the rich (the US economy.)”

The USD will no longer enjoy the monopoly on oil pricing and settlement it has enjoyed for the past forty-three years. Oil will begin to be priced in multiple currencies, likely including CNY and EUR.

When Russia and China began settling oil in physical gold, the physical oil market was some 25x the size of the physical gold market. Today, the physical oil market is only 10x the size of the physical gold market…this has been reflected in the Gold/Oil ratio (GOR), which has risen from 13x in fall 2014 to 41x today, an all-time high.

Ironically, because gold is “not used for anything,” it can be inflated as much as it needs to be in order to satisfy its role as the world’s new oil reserve asset, and I believe it will be before too long because certain people do not wish to see what happens when a significant percentage of the world’s oil production goes offline.

Paul Volcker once said, “Gold is my enemy.”

But gold really isn’t the enemy…that’s like blaming the thermometer for the temperature in Phoenix in the summertime. The enemy is unconstrained US government spending.

In contrast, the EUR and CNY mark their gold reserves to market quarterly and monthly, respectively. This means the gold reserves of the EUR and the CNY rise when gold rises. Both currencies strengthen when gold rises.

Luke: So why didn’t the Europeans tie themselves to the USD?

Mr. X: Because the people who run the EU are net creditors and net energy importers, which means it is a matter of national security to Germany and others to have and maintain cheap energy cost inputs of production.

This need is something probably deeply ingrained in the German psyche because lack of access to cheap oil is a key reason it lost World War II. Many World War II historians would tell you the Germans had better military equipment than most other combatants…but the United States and Russia had the cheap oil.

The global financial system has become dangerously unstable and faces an avalanche of bankruptcies that will test social and political stability, a leading monetary theorist has warned. “The situation is worse than it was in 2007. Our macroeconomic ammunition to fight downturns is essentially all used up,” said William White, the Swiss-based chairman of the OECD’s review committee and former chief economist of the BIS.

It will become obvious in the next recession that many of these debts will never be serviced or repaid, and this will be uncomfortable for a lot of people who think they own assets that are worth something….

No, double-entry bookkeeping requires that any such “debt jubilee” (which I agree is necessary) must be accomplished not by writing down sovereign debt, but rather, by writing up some other asset that appears on every single Central Bank balance sheet, to keep the system whole.

Do you know of any neutral reserve asset that appears on every single global Central Bank balance sheet that can be inflated to infinity with no practical direct impact on the real economy because “it is not used for anything” and which global Central Banks have recently begun buying in record amounts for the first time in forty years? [Smiling.]

Mr. X: Oh, I understand now. What is motivating the actors involved to do what they are doing? There are five historically-unique factors that no one alive has ever seen before: Demographics, Geology, Debt, Economic Reality, and the Repeated Weaponization of the Dollar.

Exactly…and estimates of the US’ entitlement liabilities range from $100T to $200T+, depending on whom you ask. Against “just” $20T in US GDP and a relatively miniscule $3.3T in US Federal tax receipts, US entitlements going free cash-flow negative is a critically-important milestone.

Mr. X: So when your nation prints the money to pay for those entitlements…and in my opinion it will print that money…your nation’s actions will massively inflate the price of oil and other commodities for every other nation on the planet, and in particular, your biggest creditors. We saw this phenomenon play out on a much smaller scale in 2011.

Luke: What do you mean?

Mr. X: The US implemented Quantitative Easing (QE) in early 2009, and while the Fed and most US pundits claimed that QE did not spur inflation, many in China and the Middle East would beg to differ…remember the so-called “Arab Spring” in 2011? Food inflation played a contributing role, did it not?

The Chinese are not making the same mistakes the US did with Bretton Woods…. It is not fixing the CNY price of gold; it is allowing gold to float. By the way, this is similar to the way the EUR treats gold with its quarterly marking to market of gold reserves.

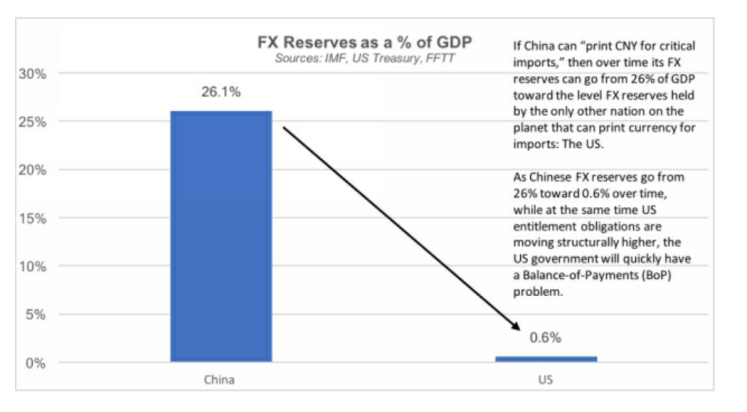

As noted in the chart, if China can effectively print CNY for oil like the US, then over time, China’s FX reserve needs will become like those of the United States, falling from 26 percent of GDP to the United States’ 0.6 percent of GDP.

Because throughout history, all sovereigns eventually default once debts get too high. Always. They may nominally default or they may default in real terms (i.e., via inflation), but they always default. There is no sovereign that has never defaulted.

Wall Street is generally a young man’s game, and as I said before, young men generally don’t learn anything from history until it happens to them.

You once wrote “Arguably the most undervalued asset on Wall Street are history books.”

I agree with investors that these trends move very slowly, that they take a long time to play out…but there comes a time when they go from impossible to inevitable without ever stopping at improbable, and they often do so extraordinarily rapidly.

Moreover, in a shift of secular or long-term significance, the markets will be adapting to a new set of rules, while most market participants will still be playing by the old rules.

The first problem is that the data tells us the neoliberal “automation took manufacturing jobs” narrative is wrong—US manufacturing jobs fell by 5.5m from 2002 to 2009 shortly after China was granted “Most Favored Nation” trading status under the WTO in 2001. I struggle to think of an automation technology advancement that would explain this big a drop occurring in so short a time.

Over the last twenty-five years, Washington leaders have followed the policies espoused by many of these same neoliberal economists, and as we showed before, Washington (and the US coasts) prospered while over the past fifteen years “flyover country” has seen an estimated 100,000-500,000 excess deaths from what is at its core “economic hopelessness” (suicides, drug overdoses, alcoholism), etc.

To my eyes, this is simple Maslow’s Hierarchy of Needs-type stuff. If you can’t afford to feed your family, issues that economic elites typically spend time at Davos talking about cease to matter to the average person.

Mr. Trump does not know it, but applying a policy of protectionism for American industry through tariffs on imports means the death of the world’s monetary system based on the dollar.

Now, Paul Krugman told me personally, that it was totally crazy to talk about the money issue. We were both from MIT, we graduated from the same school, we had the same professors, right? Here’s what he told me:

Didn’t they tell you?! Never touch the money system! NEVER touch the money system! You can touch everything else…never touch the money system…You will not be invited to the right places, and you can kiss goodbye the Nobel and anything else that is worthwhile getting. You’re killing yourself academically if you touch the money system.

Larry Summers’ comments in particular are fascinating because, on one hand, he appears to have just woken up to the reality that the policies he and other neoliberal academic economists have espoused over the past 15-20 years have created enormous economic hardship in “flyover country.” Here are some of his tweets after having read the book Hillbilly Elegy: A Memoir of a Family and Culture in Crisis by J. D. Vance that, in essence, detailed the lives of poor white people in the Midwest whom Trump mobilized to win the White House.

However, students of history would do well to notice that it was only when FDR, Winston Churchill, and other political leaders of the day stopped listening to the orthodox economists of the day and began acting on their own to devalue their currencies that the worst economic aspects of the last global sovereign debt crisis (in the 1930s) began to recede.

Putin Says Trump Is “A Smart Man”, Will Adapt To Responsibilities As “Unipolar World Model Fails” – Zero Hedge

History is clear on this count—finance follows production/manufacturing, not the other way around.

Fast forward to today and China is now “factory to the world,” and per history, China wants to leverage its productive output to gain control of the financial terms of trade for China.

With each passing day, the rest of the world needs the USD less and less. The reality is the only thing the rest of the world currently needs the USD for is to service large amounts of USD-denominated debt…. Everything else it needs it can increasingly get with CNY, JPY, EUR, or even RUB (in the case of energy).

[Comment: From Russell Clark’s Real Vision interview on Nov. 9th 2018.

]

Remember, as Hugo Salinas-Price noted, the Bretton Woods/USD reserve agreement was effectively a deal with the devil. In the near-term and medium-term, the US effectively swapped jobs and productive capacity for a debt-fueled Federal government- and consumer-spending binge, understanding that the long-term outcome would be US bankruptcy.

Even Warren Buffett felt like shorting USDs would eventually be a good idea back in 2012 (and given a slant in Berkshire’s acquisitions toward real assets in recent years, arguably even before 2012):

Most of these currency-based investments are thought of as “safe.” In truth, they are among the most dangerous of assets…their risk is huge.

In God We Trust” may be imprinted on our currency, but the hand that activates our government’s printing press has been all too human. High interest rates, of course, can compensate purchasers for the inflation risk they face with currency-based investments—and indeed, rates in the early 1980s did that job nicely. Current rates, however, do not come close to offsetting the purchasing-power risk that investors assume. Right now, bonds should come with a warning label.

– Warren Buffett, Berkshire Hathaway Annual Letter, 2012

Analysts have always been so focused on debating whether gold futures were manipulated or not that they missed the forest for the trees: The gold futures market is the manipulation! Those aren’t my words, mind you, those are the words of the US State Department. This quote came from WikiLeaks:

To the dealers’ expectations, will be the formation of a sizable gold futures market. Each of the dealers expressed the belief that the futures market would be of significant proportion and physical trading would be miniscule by comparison. Also expressed was the expectation that large volume futures dealing would create a highly volatile market. In turn, the volatile price movements would diminish the initial demand for physical holding and most likely negate long-term hoarding by U.S. citizens.

https://wikileaks.org/plusd/cables/1974LONDON16154_b.html

Now, Luke, how well do you know me? This is a copy of Edward Luce’s excellent 2012 book Time to Start Thinking: America in the Age of Descent. I’ve even taken the liberty of highlighting a few quotes from the book—they are listed on the sheet of paper stapled to the front cover. Let me read them to you:

The US is way too dependent on its military, and should sharply reduce its ‘global footprint’ by winding up all wars, notably in Afghanistan, and by closing peacetime military bases in Germany, South Korea, the UK, and elsewhere….

All this is a means to an end, which is to restore America’s economic vitality.

Our #1 goal should be to restore American prosperity. As such, we recommend the Pentagon shrink its budget by at least 20%…most of the savings would be spent on civilian priorities such as infrastructure, education and foreign aid.

Conclusions of sixteen high-ranking US military officers who participated in a 2011 strategy session at the National Defense University:

The #1 threat facing America is its rising debt burden. [This threat] is greater than that posed by terrorism, weapons of mass destruction, and global warming…. We are borrowing money from China to build weapons to face down China. That is a broken strategy…it is a failed strategy from a national security perspective.

Yes. Undoubtedly, many readers may reflexively disagree with the assessments of the senior US military personnel, the former Chairman of the US Joint Chiefs of Staff, but they shouldn’t. The logic and reasoning laid out on the front page is simply the modern version of the Asian philosopher Sun Tzu’s statement in The Art of War oft-quoted on Wall Street:

Where the army is, prices are high; when prices rise the wealth of the people is exhausted. There is no instance of a nation benefitting from prolonged warfare.

Luke: So we know the US military sees the United States’ fiscal and debt situation as a key weakness; any indication that potential US enemies might be aware of this weakness as well?

Mr. X: Based on my readings, it seems pretty safe to assume that not only are potential US enemies aware of the US’ fiscal weaknesses, but they have been actively trying to exploit them. For example, consider this article in the Epoch Times from February 16, 2016. [He handed me a printed-out page]:

Chinese general says “Contain the US by attacking its finances”

A major general in the Chinese military is calling for China to contain the United States by attacking its finances. “That’s the way to control America’s lifeblood,” writes Maj. Gen. Qiao Liang, a professor at the People’s Liberation Army (PLA) National Defense University, in an op-ed published in China Military Online, the official mouthpiece of the PLA.

In 1999, when Qiao was still a colonel, he co-authored the book “Unrestricted Warfare” with another colonel, Wang Xiangsui. In “Unrestricted Warfare,” Qiao and Wang promoted the use of terrorism, cyberattacks, legal warfare (also called “lawfare”), and economic warfare against the US.

Qiao wrote the book eighteen years ago, two years before China went into the WTO? And yet our political leaders still allowed China into the WTO!

Listen to what Ching-Hua Wang said. She was Head of the Biotechnology Department at California State University in Camarillo in 2011 when she was quoted in Luce’s book Time to Start Thinking: In China, she said, people tend to think in the long term. Americans seemingly cannot see beyond the next electoral cycle. “When I was a child [growing up in China], they had a slogan: ‘Overtake the UK and catch up with the US. China is halfway there and the goal hasn’t changed.”

This theme of the United States not having a unified strategy and politically being painfully short-sighted runs consistently throughout Edward Luce’s book:

A few months earlier, Brad Avakian [he was Oregon’s Labor Commissioner at the time] had been on an official visit to Taiwan. One evening his hosts took him out for a drink. As they began to unwind, the conversation turned to America. ‘These guys were literally laughing at America. They couldn’t understand the game we were playing. They said “Please keep sending us all the jobs, everything else will follow.”

And the frustration with US political decision-making appears to extend from the “military” to the “industrial” portion of what your President Eisenhower called the “military-industrial complex.” GE CEO Jeffrey Immelt is quoted in Luce’s book as saying:

If you even whisper the phrase “industrial policy” in Washington DC today, within 24 hours you will be stoned to death. I mean, China is out there eating [our] lunch every day but we still won’t challenge the orthodoxy…. I read all these Washington economists’ reports and think tank studies that say “Let the market work”, except that the guys who are writing the books in China think it’s f***ing bullsh*t. [They say] “Please let those guys in Washington keep reading those books. Things are going just fine!”

Why would establishment pundits be so against a message that is in many ways the same message written some six years ago, by some of the very best and brightest in the US military? The following quote by the American economist Murray Rothbard comes to mind:

If authentic free trade ever looms on the policy horizon, there’ll be one sure way to tell. The government/media/big-business complex will oppose it tooth and nail. We’ll see a string of op-eds “warning” about the imminent return of the 19th century.

Krugman says “Deficits are good” on 10/22/16, then reverses himself and says “Deficits bad” on 1/9/17

http://krugman.blogs.nytimes.com/2016/10/22/debt-diversion-distraction/

https://www.nytimes.com/2017/01/09/opinion/deficits-matter-again.html

Luke: China and Russia know they don’t have to go to war with the US to win…all they have to do is avoid going to war with the US and let the magic of compounding interest do its job. The US cannot afford both its military at current spending levels and its entitlement obligations at future-promised levels for very much longer.

Mr. X: No, they cannot, and everyone knows it…well, everyone except the American people and most Western investors who are hyper-focused on short-term trading moves.

Mr. X: Judging by a speech that former BIS and (current OECD Economic Committee Chairman) William White gave back in October 2016, we can also infer that both the EU and the BIS know it:

I am going to tell a less pleasant story. That is that we get an assumed slowdown or a global recession…but in countries that started off with a very bad fiscal situation, there is a lot of history that indicates that a slowdown, when a country faces a very bad fiscal situation, leads to still more recourse to the central bank and to people, ordinary people and traders, seeing the writing on the wall that central bank financing will eventually lead to inflation. Everybody says: “I am out of here.” There is a currency collapse and hyperinflation. We have seen it many times in history in the worst of the worst-case scenarios.

– Ultra-Easy Money—Digging the Hole Deeper? William White, October 2016, in Singapore

Larry Lindsay (LL):

The Social Security Disability fund has been cash flow negative for the past 3 years, meaning we’running down the Trust balances. That trust will be exhausted in the late 2020’s… current law says that when that happens, all recipients will see benefits cut by 27%…

“Unfunded Social Security and Medicare/Medicaid liabilities when added together to US Federal debt take US obligations closer to 300% v. 100%, which is more than Greece’s debt.

The financial arrangements of the state are no longer sustainable… it is not a great pretty change if we get there, and it is a matter of political liberty because government will NOT voluntarily let itself go out of business… it will use all its power available to government to fund itself. By the way, this always ends this way- Rome, the Ming Dynasty, Zimbabwe… it’s so depressing. It always, always, always ends this way, this end game we’re talking about.

Mr. X: What has the United States’ largest export been for the last twenty years or so?

Luke: I don’t know—Aerospace/Defense, or maybe technology?

Mr. X: No, not even close. The United States’ largest export for the last twenty years or so has easily been USDs &/or USTs.

Mr. X: However, since the third quarter of 2014, the world has stopped stockpiling FX reserves for the first time in seventy years.

In essence, the chart shows that the world is saying to the US “The prior (USD-centric) deal is off.”

Luke: That seems like a pretty big deal.

Mr. X: Oh, it’s not just “a pretty big deal”…it’s the biggest deal! Once global FX reserves began falling, the US faced a choice: It could go to war to force the world to begin stockpiling FX reserves again, or it could change the deal. While most US citizens don’t seem to be aware of it, in my eyes, it appears Hillary Clinton was preparing to take the former tact as outlined in The Washington Post on October 20, 2016:

The Republicans and Democrats who make up the foreign policy elite are laying the groundwork for a more assertive US foreign policy, via a flurry of reports shaped by officials who are likely to play senior roles in a potential Clinton White House.

And listen to this opinion from the website heatst.com:

Putin’s advisor Sergei Glaziev went as far as to officially suggest that Trump’s victory saved the world from WW3. “Americans had two choices: WW3 or multilateral peace. Clinton was a symbol of war, and Trump has a chance to change this course.”

[Kremlin: Clinton victory would have led to World War 3 between Russia & the US – 11/9/16

After all, as Larry Summers noted when interviewed in Luce’s Time to Start Thinking, quoting Winston Churchill:

“America will always do the right thing…after exhausting all the alternatives.”

Historically, when EMs have tried to gain their monetary and political independence from the USD, the US has “weaponized” the USD to bring them to heel. Now, it’s typically not talked about out loud in polite circles on Wall Street, but we can infer that all the major players in this game understand this because they have all explicitly stated it.

And here’s how Russia is responding, as expressed by Putin’s top economic advisor, Sergey Glaziev, in a recent article:

America’s aggression around the world is rooted in its aspiration to preserve US hegemony when they have already yielded economic leadership to China,” he said. “The United States has no tools to make all others use the dollar other than a truncheon. That is why they are indulging in a hybrid war with the entire world to shift their debt burden on to other countries, to confine everyone to the dollar and weaken territories they cannot control.

The more aggressive the Americans are the sooner they will see the final collapse of the dollar as the only way for the victims of American aggression to stop this aggression is to get rid of the dollar. As soon as we and China are through with the dollar, it will be the end of the United States’ military might.

…as it always happens when a global leader is changed, the war is for control over rimland nations. During WWI and WWII, Britain acted as an instigator in a bid to keep its global leadership. Now the US is doing the same….

[Kremlin advisor reveals ‘cure for US aggression’: ‘Russia & China getting rid of the USD’ – 3/21/17

http://tass.com/politics/942643]

In his speech, Qiao explained that he has been studying finance theories and concluded that the U.S. enforces the dollar as the global currency to preserve its hegemony over the world. The U.S. will try everything, including war, to maintain the dollar’s dominance in global trading. He also discussed China’s strategy, to rise as a super power, amid the U.S.’s containment.

The old script the United States used to follow was that it would tighten USD liquidity until another nation that couldn’t print USD essentially broke on the rocks of the strong USD. Historically, that was an EM or EM region, but as a practical matter, it could be anyone. Here was the key: The USD merely had to ensure it was not the first currency over the cliff. If any other nation went over the cliff first, it would trigger a flood into USDs for safety, and the USD’s hegemony would be maintained and restored.

The Triffin Dilemma, in essence, says that if one nation uses its currency as the reserve currency for the world, it must run ever-growing deficits to supply the currency needed for the global economy. Ultimately, these deficits drive such a significant hollowing out of domestic productive assets that foreign creditors of the issuing nation begin to question the issuing nation’s ability to repay sovereign debt in real terms.

Luke: What’s the really positive outcome?

Mr. X: A systemic restructuring of the global currency system that ends up significantly reducing the USD’s role as primary global reserve currency, effectively devaluing the USD against some sort of neutral asset—gold, or perhaps SDRs.

Luke: What’s the really negative outcome?

Mr. X: World War III where the United States fights China and Russia, as Graham Allison has begun to discuss as a risk in his book Thucydides’ Trap.

Luke: So what are the United States’ options if it is to avoid World War III?

Mr. X: They are fairly straightforward. Once another nation gains the ability to print its own currency for oil as it appears China has, there are three possible outcomes for the US:

- Slash US government spending to maintain the value of the USD: Rising healthcare premiums under ACA and falling US infrastructure spending are symptoms that this has been tried, but at ~22% of US GDP, the US cannot slash US Federal spending without counterproductively crashing both the US economy and US Federal tax receipts (thereby widening the deficit.)

- Have the Fed print all the “helicopter money” needed to fund US Federal deficits: This would be negative for the USD, and was frowned upon as a strategy by the BIS in a white paper from late 2016.

- Devalue/weaken the USD significantly, thereby increasing US tax receipts and rebalancing the US economy away from consumption toward production, centered around US energy and alternative energy sectors and infrastructure as US energy costs rise.

As I noted before, the first option has been tried, but it became counterproductive once US deficits began widening in the third quarter of 2016. The second option was frowned upon by the BIS in the same quarter after Ben Bernanke began writing some articles floating helicopter money trial balloons…leaving only the third option, in my opinion.

Luke: A major USD devaluation occurring through a systemic restructuring would likely have tectonic implications for investment returns, no?

Mr. X: Yes, and in my eyes, it appears that many of the usual suspects are once again positioned to get run over by this trend—retirees, commercial banks, pensions—all holding USTs and other low-rate fixed rate debt for “safety,” not realizing what Warren Buffett said about fixed rate debt five years ago.

Luke’s website:

https://fftt-llc.com/