Volatility in Finance

The main theme in financial markets over the past weeks has without a doubt been volatility.

Volatility in finance is used to measure how much prices of an asset change over time. There are two kinds of volatility that are of particular interest: realized volatility, i.e. a measure of how much prices changed in the past and expected volatility, i.e. a measure of how much prices are expected to change in the future. While realized volatility cannot really be traded, expected volatility can. Indirectly this is done by selling insurances on an asset price, i.e. options, or in a fancier way by exotic derivatives that directly reflect the expected volatility of the underlying asset.

On the left: The Dow Jones had a relatively low realized volatility (except for the recent crash), prices often only change one or two percent a day. On the right: Bitcoin has a high realized volatility, prices sometimes change 20 or 30 percent in a day.

The most known volatility derivatives are VIX futures that reflect the expected volatility of the SP500, the main US stock index.

However each VIX future contract costs several thousand dollars, not really the kind of product accessible to the average retail investor. As a result, a further derivative has been created that slices the future contracts into small pieces. For betting on increasing SP500 volatility you could for example buy the VXX derivative product and for betting on decreasing SP500 volatility you could buy the XIV derivative product.

Note that for example the XIV is a derivative of a derivative (VIX futures) of a portfolio of derivatives (options) of a derivative (SP500 futures) of the SP500, i.e. a tripled layered derivative. What could possibly go wrong?

Note also that usually asset volatility tends to be low when prices rise and asset volatility tends to be high when prices fall, the analogy is that stocks take the stairs to go up and the elevator to go down. (See also Dow Jones chart above.)

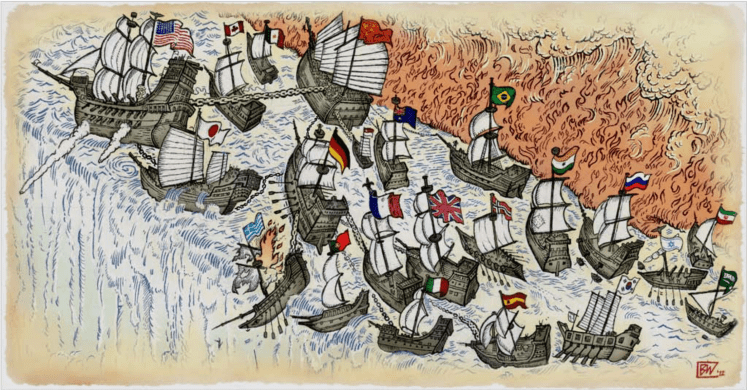

Over the past several years asset volatilities have faded lower and lower reaching historic all time lows while at the same time, asset prices have smashed higher and higher. Almost everything was – up until recently – at all time highs, be it stocks, bonds, real estate, art, cryptocurrencies and that in almost every country in the world (only commodities have been spared).

However, beginning of January, something unusual started to happen, the SP500 smashed one record high after another but this time realized volatility rose, breaking with the old tradition.

(C.f. This Is What Market Madness Looks Like)

This motivated me to reread all Artemis Capital papers, my all time favorite finance reads. And exactly as described in great detail in the papers, expected volatility of the SP500 in the past week exploded, virtually wiping out the corresponding retail derivatives that were betting on falling expected volatility.

(C.f. “Termination Event” Arrives: Traders Panic As XIV Disintegrates -90% After The Close)

Note that so far, the worst case has been averted as by betting on lower volatility one could lose much more that one’s initial bet.

While at first, only expected volatility in the SP500 exploded without following through into realized volatility: the derivative induced crash prediction of approximately 15% last Monday was in fact of only 4%. It was speculated that this was only a derivative anomaly and that everything else was “normal”. That however, quickly turned out to be not the case and markets around the world have been crashing ever since, in particular China’s future Lehman Brothers (?) – the conglomerate HNA – has now started with fire sales. This should get interesting.

The most important question now is, when will central banks again bail out the financial system?

And as a result, the Fed is again trapped: if the selloff continues – or accelerates – next week will face a lose-lose dilemma – bail out retail (and institutional) vol sellers, and while preventing trillions in losses, lose all credibility and confirm that the “coordinated recovery and strong economy” narrative was a lie all along, while derailing what is likely the last tightening cycle; or allow normalization to take place, and watch as trillions vaporize from the Fed’s artificial “wealth effect.”

We wish Jay Powell the best of luck as he faces the most critical question of his career just days into his tenure as the Fed’s new chair, and wish to remind him of what he said at the October 2012 FOMC meeting:

I think we are actually at a point of encouraging risk-taking, and that should give us pause. Investors really do understand now that we will be there to prevent serious losses. It is not that it is easy for them to make money but that they have every incentive to take more risk, and they are doing so. Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy.

Recall from late last year that those betting on lower volatility are mainly retail investors and pension funds:

And to finish.

An anecdote from Artemis’ papers illustrating the current volocaust

The Sorcerer’s Apprentice Die Geister, die ich rief …. the spirits that I called…

The Sorcerer’s Apprentice by Goethe (1797) is a classic German poem that begins when a powerful sorcerer retires from his workshop tasking his young apprentice with the chore of filling a large vat with water. The lazy apprentice, tired of fetching water with a bucket, uses his master’s magic and enchants a broom to complete the task for him. When the broom comes alive and begins fetching the water the apprentice is delighted! Alas the boy is not fully trained in the magic he is attempting to yield and the broom will not cease filling the vat with water even after it is full. Before long the workshop is flooded and apprentice is unable to control the spell he has cast. In desperation he takes an axe and splits the broom in two but this only makes things worse. Now the two pieces of the broom come alive and begin fetching water anew at twice the speed. The workshop is now overflowing and the apprentice has no choice but to call his master for help. When all seems lost the Sorcerer reappears … he calls off the magic spell and the brooms fall lifeless to the floor. The Sorcerer’s final warning to the boy is that those untrained in the art of black magic risk great danger by calling upon spirits they are not capable of controlling.

And here are all the articles I found most interesting over the past four weeks:

World News Aggregation Week 3, 4, 5 & 6

Finance

- “Termination Event” Arrives: Traders Panic As XIV Disintegrates -90% After The Close

- Contagion: Credit Crashes To 14-Month Wides Amid Soaring Outflows

- “Do I Have To Worry About Another Volatility Spike”- A Q&A With Goldman’s Head Quant [highly technical]

- XIV Trader Loses $4 Million And 3 Years Of Work Overnight: Here Is His Story

- Zero Lessons Learned: Retail Investors Are Again Pouring Money Into Short VIX ETFs [Ex-Target manager doubling down, you can’t make this up…]

- Another Ponzi Exposed As Long-Term Care Insurers Double Premiums To Stave Off Losses

- Deutsche: The Fed Now Appears Powerless To Stop This “Unprecedented Bubble”

- Mauldin: “Flying Blind At 20x” On The Brink Of Another Housing-Driven Global Crisis

- ECB “In Touch With Market Participants” Over Market Crash; White House “Concerned”

- “The Market Is On The Edge Of Chaos, A Zone Where Rare Events Become Typical”

- These Are The 6 Traders Who Were Just Arrested For Manipulating The Gold Market

- The Firesale Begins: China’s HNA Starts Liquidating Billions In US Real Estate

- Ken Rogoff Warns “China Will Be At The Center Of The Next Global Financial Crisis” [absolut must read – “negative interest rates are the most elegant solution”… yeah, good luck with that]

- China Downgrades US Credit Rating From A- To BBB+, Warns US Insolvency Would “Detonate Next Crisis”

- Illinois Unveils Another Shocker: Sell A Record $107 Billion In Debt To Fund Insolvent Pensions

- The Fed Will Ignite The Next “Financial Crisis”

Artemis Capital Papers

- Volatility at World’s End Deflation – Hyperinflation and the Alchemy of Risk [One of my all time favorite finance reads, though highly technical, see also shorter ZH version here]

- Volatility and the Allegory of the Prisoner’s Dilemma – False Peace, Moral Hazard, and Shadow Convexity [the easiest to read and to understand the current volatility dynamics]

- Volatility and the Alchemy of Risk [the most recent one, see also ZH’s take: The ‘Hyper-Crash’ Is Coming – It’s Not The Everything Bubble, It’s The Global Short Volatility Bubble]

- Volatility of an Impossible Object Risk – Fear, and Safety in Games of Perception

Source: Artemis Capital Research (including the magnificent cover illustration)

Artemis Capital’s take on the recent events:

“This is just an appetizer for what has yet to come,” said Chris Cole of Artemis Capital, a hedge fund for investors who believe in such an outcome. “The world won’t end tomorrow, but there has been such a massive bet on stability and low volatility that this could lead to a multiyear unwind.”

See also an artistic visualization of past VIX movements:

Energy & Geopolitics

- Amar Inamdar: The thrilling potential for off-grid solar energy | TED Talk

- How Tesla Will Change The World | Wait But Why

- The Breakneck Rise of China’s Colossus of Electric-Car Batteries | Bloomberg New Energy Finance [The switch to all electric will be fast]

- Is This The World’s Most Critical Pipeline?

- Tesla Building 250MW “Virtual Solar Power Plant” Using 50,000 Homes In Australia

- Trump Fires Latest Shot In Trade Wars – Imposes 30% Tariff On Solar-Panel Imports [Though easily circumvented (for now)]

- US And China Brace For Trade War That Could Rattle Global Economy

- 2018 Looks To Be Another Good Year For Weapons-Makers

- Trump Ups Defense Budget By 13% – “Can’t Have World’s Best Military On An Obama Budget” [complementary to the article above]

- China Deploys 300,000 Soldiers To N.Korean Border In “Preparation For Potential War”

- New Surveillance Images Show Beijing’s Militarization Of South China Sea [many “beautiful pictures”, also note the solar panels and wind turbines on one of the islands]

- Watch A Sitting Congresswoman Shred The MSM Narrative In Under A Minute [Summary of US geopolitics]

- “Son Of A Bitch Got Fired!”: Joe Biden Brags He Forced Ukraine To Fire Key Official In Exchange For Money

- Pakistan ‘Pivots’ To Purchase Weapons From China/Russia After Trump Halts Military Aid

- “One Typhoon Away From Full Breach” – US Nuke-Test Dome Leaking Fatal Radiation Into Pacific Ocean

- US-Led Coalition Bombs Syrian Forces Following Israeli Strike Near Damascus

Technology

- The Era Of AI-Generated ‘Fake Porn’ Has Arrived

- Amazon Patents Ultrasonic Tracking Wristbands To Control Workers

- Trump Administration To Test Biometric Program To Scan Faces Of Drivers

- Falcon Heavy Makes History – Cheaper Spaceflight – YouTube

- Amazon, Berkshire And JPMorgan To Form Healthcare Company “Free From Profit-Making Incentives”

Cryptocurrencies

- Meet The World’s Next Central Banker: Mark Zuckerberg

- Cryptocurrencies Surge As South Korea Backs Off Crypto Ban

- “Biggest Theft In Crypto History”: Over $400MM Stolen From Japanese Crypto Exchange

- Japanese Police Launch Probe Of Biggest Cryptocurrency Heist In History

- Cryptos Tumble After India Says It Will “Take All Measures To Eliminate” Their Use

Talks

- Neil Gaiman – Inspirational Commencement Speech at the University of the Arts 2012 – YouTube [Tim Ferriss’ all time favorite]

- Guy Winch: How to fix a broken heart | TED Talk

- Megan Phelps-Roper: I grew up in the Westboro Baptist Church. Here’s why I left | TED Talk

One thought on “World News Aggregation Week 3, 4, 5 & 6 – Volatility in Finance”