My favorite articles this week:

- AI Researcher Warns Skynet Killer-Robots “Easier To Achieve That Self-Driving Cars”

- The Moment Gary Cohn Realized His Entire Economic Policy Is A Disaster

- Fed Hints During Next Recession It Will Roll Out Income Targeting, NIRP

- Can You Do A Backflip? Because This Robot Can

- Bank Of America: This Is What $700 Quintillion Could Buy You Today

- S&P Downgrades Venezuela To “Selective Default” After Bondholder Meeting Devolves Into Total Chaos

- Libya’s Slave Auctions And African Genocide: What Hillary Knew

I believe that we live in unprecedented times on so many levels and it is fascinating but also frightening to observe this world change at breakneck pace. The sheer amount of real-time newsflows paired with an insatiable curiosity can make this quite overwhelming on more than one occasion. As my defacto news aggregator I find myself choosing the financial blog Zero Hedge over and over again (more on that in a future post). Unfortunately, what I often deem to be master pieces in reporting get quickly drowned on the site’s 50+ highly dense daily posts (with some guest posts of particular low quality). Since I already meticulously record and rate everything I read, maybe some people will find this news presentation (more) helpful. Anyways, here is what I found particularly interesting this week with some addition comments and highlights:

From AI Researcher Warns Skynet Killer-Robots “Easier To Achieve That Self-Driving Cars”:

A group of the world’s leading AI researchers and humanitarian organizations are warning about lethal autonomous weapons systems, or killer robots, that select and kill targets without human control.

[…]

The video portrays not to far in the distant future of a military firm unveiling a drone with shaped explosives that can target and kill humans on its own. Further in, the video abruptly changes pace, when bad guys get ahold of the technology and unleash swarms of killer robots onto the streets of Washington, D.C. and various academic institutions.

The video is aggressive and graphic but outlines if the technology was misused it could have severe consequences – such as civilian mass causality events.

And also

Human Rights Watch is another organization calling for the preventive measures to stop the machines…

The development of fully autonomous weapons—“killer robots”—that could select and engage targets without human intervention need to be stopped to prevent a future of warfare and policing outside of human control and responsibility.

Unfortunately, the genie for this technology has probably already left the bottle. A quick google for “drone racing” paired with this open source real-time object detection AI (see also TED-talk: How computers learn to recognize objects instantly) for example may already do the trick for under $200 today… (An even broader perspective: Ted-Talk A vision of crimes in the future.)

* * *

ZH continued with it’s latest series on robots with: Can You Do A Backflip? Because This Robot Can.

Since being founded in 1992 with funding from DARPA, robotics company Boston Dynamics has unveiled one nightmarish robotic creation after another. But the company outdid itself this week when it introduced the latest iteration of its ‘Atlas’ robot.

(Version 1 was documented here: Google’s “SkyNet” Robots Are All Grown Up, And Terrifying)

Moving over to finance, ZH once again shows that the western world – with the USA leading the way – are working hard on becoming the next banana republic. To wit:

Ever since 2012 (see “How The Fed’s Visible Hand Is Forcing Corporate Cash Mismanagement“) we have warned that as a result of the Fed’s flawed monetary policy and record low rates, corporations have been incentivized not to invest in growth and allocate funds to capital spending (the result has been an unprecedented decline in capex), but to engage in the quickest, and most effective – if only in the short run – shareholder friendly actions possible, namely stock buybacks.

[…]

The eagerness to shift incentives away from buybacks to capex is also the basis for much of Trump’s economic policy as designed over the past year by his top economic advisor, former Goldman COO Gary Cohn who is the White House Economic Council director. In fact, the motive behind the administration’s entire push for tax reform (cutting corporate tax rates) and offshore cash repatriation, is to the funds domestically, though not on buybacks and M&A (which also leads to “synergies” and other headcount reductions), but on reinvesting the funds in growing one’s business and hiring.

Which is why we were amused to observe the following brief interchange yesterday between Gary Cohn and an audience made up of executives, where in the span of a few seconds Gary Cohn realized that his entire economic policy had been a disaster.

During an event for the Wall Street Journal’s CEO Council, an editor at The Wall Street Journal asked the room: “If the tax reform bill goes through, do you plan to increase investment — your company’s investment, capital investment?” He asked for a show of hands.

Alas, as the camera revealed, virtually nobody raised their hand.

VIDEO: CEOs asked if they plan to increase their company’s capital investments if the GOP’s tax bill passes.

A few hands go up.

“Why aren’t the other hands up?” Gary Cohn asks.#WSJCEOCouncil pic.twitter.com/TD2oAlN27S— Natalie Andrews (@nataliewsj) November 14, 2017

* * *

However, rest assured, central banks are already planing for the next crash: Fed Hints During Next Recession It Will Roll Out Income Targeting, NIRP. A must-read.

On Thursday afternoon, in a stark warning of what’s to come, San Francisco Fed President John Williams confirmed our suspicions when he said that to fight the next recession, global central bankers will be forced to come up with a whole new toolkit of “solutions”, as simply cutting interest rates won’t well, cut it anymore, and in addition to more QE and forward guidance – both of which were used widely in the last recession – the Fed may have to use negative interest rates, as well as untried tools including so-called price-level targeting or nominal-income targeting.

The bolded is a tacit admission that as a result of the aging workforce and the dramatic slack which still remains in the labor force, the US central bank will have to take drastic steps to preserve social order and cohesion.

According to Williams’, Reuters reports, central bankers should take this moment of “relative economic calm” to rethink their approach to monetary policy. Others have echoed Williams’ implicit admission that as a result of 9 years of Fed attempts to stimulate the economy – yet merely ending up with the biggest asset bubble in history – the US finds itself in a dead economic end, such as Chicago Fed Bank President Charles Evans, who recently urged a strategy review at the Fed, but Williams’ call for a worldwide review is considerably more ambitious.

Among Williams’ other suggestions include not only negative interest rates but also raising the inflation target – to 3%, 4% or more, in an attempt to crush debt by making life unbearable for the majority of the population – as it considers new monetary policy frameworks. Still, even the most dovish Fed lunatic has to admit that such strategies would have costs, including those that diverge greatly from the Fed’s current approach. Or maybe not: “price-level targeting, he said, is advantageous because it fits “relatively easily” into the current framework.”

[…]

Meanwhile, the idea of Fed targeting, or funding, “income” is hardly new: back in July, Deutsche Bank was the first institution to admit that the Fed has created “universal basic income for the rich”:

The accommodation and QE have acted as a free insurance policy for the owners of risk, which, given the demographics of stock market participation, in effect has functioned as universal basic income for the rich. It is not difficult to see how disruptive unwind of stimulus could become. Clearly, in this context risk has become a binding constraint.

It is only “symmetric” that everyone else should also benefit from the Fed’s monetary generosity during the next recession.

* * *

Finally, for those curious what will really happen after the next “great liquidity crisis”, JPM’s Marko Kolanovic laid out a comprehensive checklist one month ago. It predicted not only price targeting (i.e., stocks), but also negative income taxes, progressive corporate taxes, new taxes on tech companies, and, of course, hyperinflation. Here is the excerpt.

What will governments and central banks do in the scenario of a great liquidity crisis? If the standard rate cutting and bond purchases don’t suffice, central banks may more explicitly target asset prices (e.g., equities). This may be controversial in light of the potential impact of central bank actions in driving inequality between asset owners and labor. Other ‘out of the box’ solutions could include a negative income tax (one can call this ‘QE for labor’), progressive corporate tax, universal income and others. To address growing pressure on labor from AI, new taxes or settlements may be levied on Technology companies (for instance, they may be required to pick up the social tab for labor destruction brought by artificial intelligence, in an analogy to industrial companies addressing environmental impacts). While we think unlikely, a tail risk could be a backlash against central banks that prompts significant changes in the monetary system. In many possible outcomes, inflation is likely to pick up.

The next crisis is also likely to result in social tensions similar to those witnessed 50 years ago in 1968. In 1968, TV and investigative journalism provided a generation of baby boomers access to unfiltered information on social developments such as Vietnam and other proxy wars, Civil rights movements, income inequality, etc. Similar to 1968, the internet today (social media, leaked documents, etc.) provides millennials with unrestricted access to information on a surprisingly similar range of issues. In addition to information, the internet provides a platform for various social groups to become more self-aware, united and organized. Groups span various social dimensions based on differences in income/wealth, race, generation, political party affiliations, and independent stripes ranging from alt-left to alt-right movements. In fact, many recent developments such as the US presidential election, Brexit, independence movements in Europe, etc., already illustrate social tensions that are likely to be amplified in the next financial crisis. How did markets evolve in the aftermath of 1968? Monetary systems were completely revamped (Bretton Woods), inflation rapidly increased, and equities produced zero returns for a decade. The decade ended with a famously wrong Businessweek article ‘the death of equities’ in 1979.

Kolanovic’s warning may have sounded whimsical one month ago. Now, in light of Williams’ words, it appears that it may serve as a blueprint for what comes next.

* * *

While some may be concerned by a resource finite planet, some are attempting “moon shot projects” that may or may not solve all our current problems: asteroid mining. Some excerpts from Bank of America: This Is What $700 Quintillion Could Buy You Today.

In a whimsical, 100+ page report, meant to literally drum up interest in investing in an entirely new frontier, Bank of America tries to address the untapped “space” opportunity from the perspective investors. The Primer “sets out the challenges and opportunities posed by Space” and, predictably, concludes that lots of money is to be made, just call now as “we are entering an exciting era in Space where we expect more advances in the next few decades than throughout human history.” More:

The original 20th century Space Race was all about the Cold War superpowers, and military/defense interests (US DoD) will remain a key driving force of the new Space Race. However, we see a raft of new drivers including private company innovation (SpaceX reusable launch), commercial activity (3/4 of the Space industry), the involvement of new countries (80+ countries with satellites in orbit), and falling launch costs (Rocket Lab – US$5mn). Stakeholder support remains strong (7/10 Americans rate NASA favorably) as does the regulatory backdrop (SPACE Act 2015, Trump administration).

While BofA is not the first, and certainly won’t be the last, to urge investors to literally send their money into cold vacuum of space where stratospheric (P/E) opportunities await, and far from the boring, gravitational confines of earth, what is notable about the report, are its attempts to quantify instead of just qualifying the opportunity.

According to BofA, the numbers are as follows: $339bn space market today growing to $2.7 trillion by 2045E, with BofA making the following clarification: “It has traditionally been difficult for companies to make money from Space, with high capex requirements and frequent delays. However, for those wishing to take a truly long-term time horizon we see it as one of the final frontiers of investing. The market is expected to grow from US$339bn in 2016 to US$2.7tn by 2045E. Over US$16bn has been invested in Space start-ups since 2000, with 2016 seeing a record US$2.8bn.”

[…]

So what could 700 quadrillions (a 7 with 20 zeros after it) dollars buy you these days? Here is BofA’s explanation:

“The first trillionaire there will ever be is the person who exploits the natural resources on asteroids. There’s this vast universe of limitless energy and limitless resources. – Neil deGrasse Tyson, Astrophysicist

[…]

Asteroid Mining: US$700 “quintillion” in Mars/Jupiter asteroid belt: The mineral wealth of the asteroid belt would amount to US$100bn for each person on Earth

[…]

However, asteroid mining is costly. NASA estimates it would cost US$1bn today to bring back 2oz of an asteroid – the weight of a tennis ball. On the other hand, a study at the Keck Institute for Space Studies (KISS) at Caltech estimates that one full cycle Asteroid Capture and Return mission, moving an asteroid weighing about 1.1 million pounds (500,000kg) to a high lunar orbit by 2025, would cost approximately US$2.6bn. An MIT study (Schuler, 2011) found that opening a mine and separation plant can cost up to US$1bn.

[…]

Planetary Resources

Planetary Resources is an American company with a stated goal to “expand Earth’s natural resource base” by developing and deploying the technologies for asteroid mining. It is backed by Peter Diamandis, James Cameron, Larry Page, Eric Schmidt, Richard Branson and Tencent among other investors. The company is developing Asteroid Exploration program for launch readiness by end of 2020 and targeting multiple C-type asteroids for exploration by multiple spacecraft. According to President Chris Lewicki, the first mission should take place in 2020.

[…]

Deep Space Industries

Deep Space Industries (DSI) is another American privately held company with global operations in the space technology and resources sectors. The company is developing spacecraft technologies that are needed for asteroid mining, and is selling satellites that use these technologies. DSI is expecting to make in-space materials, extracted from asteroids, commercially available in the early 2020s, include space-based refuelling, power, asteroid processing, and manufacturing.

* * *

Back on earth however, on Wednesday, courtesy of S&P Downgrades Venezuela To “Selective Default” After Bondholder Meeting Devolves Into Total Chaos, we were given a fascinating peek behind the curtain into a nation – Venezuela – further spiraling out of control. (Default confirmed later this week.)

Creditors had little expectations from today’s ad hoc meeting with “soon-to-default” Venezuela, and with good reason: not only was the meeting attended by several sanctioned Venezuelan officials, potentially jeopardizing the legal status of any bondholders who voluntarily appeared at the Caracas meeting meant to “restructure and refinance” Venezuela’s massive debt load, but it was nothing but total confusion, with neither Venezuela, nor creditors knowing what is on the agenda, why they were meeting, or what is the endgame. In sum, the meeting resulted in no firm proposals, lasted no more than 30 minutes, consisted largely of an angry rant by an alleged drug dealer who also happens to be Venezuela’s vice president, and ended as chaotically as it started.

Quoted by Reuters, one unnamed bondholder had a perfectly succinct summary of what happened today, or rather didn’t:

“There was no offer, no terms, no strategy, nothing,” the bondholder said, leaving the meeting that lasted a little over half an hour at the ‘White Palace’, departing with a colorful gift-bag containing Venezuelan chocolates and coffee.

Credit walked in as confused as they left, a little over a week after President Nicolas Maduro stunned investors with a vow to continue paying Venezuela’s crippling debt, while also seeking to restructure and refinance it; the two things are literally impossible at the same time. There is another problem: both a restructuring and a refinancing appears out of the question, due to U.S. sanctions against the crisis-stricken nation, which make discussions with the key negotiators who has been put on a sanctions black list, grounds for potential arrest. A default would compound Venezuela’s already disastrous economic crisis.

As Reuters reports, Monday’s short and confused meeting, attended by senior Venezuelan officials blacklisted by the United States, gave no clarity on how Maduro would carry out his plan, bondholders and their representatives who participated said afterwards.

That means Venezuela remains with the dilemma of whether to continuing paying debt at the expense of an increasingly hungry and sick population, or defaulting on creditors and burning its bridges to the global financial system.

Vice President Tareck El Aissami, the only government official to speak, devoted most of his remarks to railing against Donald Trump and global financiers who he said have conspired to keep the country from making debt payments on time. He pledged Venezuela would continue to honor its obligations while working to form committees with bondholders to figure out the next steps. He offered no specific proposals for restructuring, according to Bloomberg which was briefed by people who attended the meeting, which wasn’t open to journalists.

The surreal procession of Venezuela’s descent into insolvency started earlier:

The event, held across from the presidential palace at Palacio Blanco, was accompanied by much fanfare, with a literal red carpet laid out for attendees who passed through an honor guard on their way into the building. After government Twitter accounts sent repeated invitations to the meeting over the past week, it appeared that no more than 100 people showed up, and none of them were allowed to ask any questions publicly. Finance Minister Simon Zerpa, Oil Minister Eulogio del Pino, PDVSA President Nelson Martinez and planning vice president Ricardo Menendez were in attendance.

The most notable presence, however, was that of chief debt negotiators Vice President Tareck El Aissami and Economy Minister Simon Zerpa – whom the U.S. previously sanctioned for drug trafficking and corruption charges respectively – who attended the meeting for half an hour. As Reuters recounts, “they met with some bondholders, while others stayed out of the room on concerns about penalties for dealing with officials sanctioned by Washington.”

At that point the meeting turned even more bizarre:

El Aissami told creditors that Deutsche Bank may soon cut off some financial services to Venezuela, participants said. He read a statement protesting unfair treatment by global financial institutions, including U.S. President Donald Trump’s sanctions aimed at preventing Venezuela from issuing new debt.

In retrospect, the move was at least somewhat clever: “Now Maduro can say: ‘I showed goodwill, the bondholders showed goodwill … but unfortunately because Uncle Sam is not playing ball we can’t (refinance)’,” said Jan Dehn, Head of Research at Ashmore Investment Management, who did not attend the meeting. “I‘m not hugely surprised nothing’s come out of that meeting.”

[…]

Meanwhile, for Maduro the choice is simple: keep paying creditors and preserve some minute, if irrelevant, access to capital markets, or conserve the cash and feed the starving domestic population. The sight of poor Venezuelans eating from garbage bags has become a symbol of Venezuela’s socialist decay. It contrasts sharply with the era of Chavez, when high oil prices helped fuel state spending.

According to Reuters, halting debt service would free up an additional $1.6 billion in hard currency by the end of the year. Those resources could be used to improve supplies of staple goods as Maduro heads into a presidential election expected for 2018. But the strategy could backfire if met with aggressive lawsuits. A default by PDVSA, which issued about half of the country’s outstanding bonds, could ensnare the company’s foreign assets such as refineries in legal battles – potentially crimping export revenue.

Which is why when choosing between keeping its creditors happy or feeding its people, Maduro will always pick the former…

* * *

Finally, we witnessed what happens after the West arms a few rebels and bombs a nation back into the stone age. In the case of Libya, a few years down the road, it now finds itself with a flourishing slave market.

A new CNN investigation has uncovered a network of slave markets operating in warehouses in various cities across Libya six years after NATO-led intervention in the country toppled the government of Muammar Gaddafi in support of US and UK backed rebels. And not only did CNN confirm the presence of slave auctions where human beings are being sold for as little as $400 in “liberated” Libya, but CNN’s crew was actually able to film a live auction in progress, while also gathering the testimonies of multiple victims.

Though CNN’s footage and accompanying report is shocking, such practices have been quietly documented for years, and clear warnings were issued starting in early 2011 that Libya’s black as well as migrant population would be the first to fall victim at the hands of the Islamist Libyan rebels that NATO’s war empowered. From the outset critics of Western intervention in Libya loudly sounded the alarm of a genocide against black Libyans in progress committed by the very rebels the US, UK, France, and Gulf allies were arming – a fact so well-known that then Secretary of State Hillary Clinton was personally briefed and warned on the matter.

More in the main article Libya’s Slave Auctions And African Genocide: What Hillary Knew.

And some further possibly unique perspectives on geopolitics, finance, tech and some TED-talks.

Geopolitics

- Mysterious Turk At Center Of “Secret Gold” Trade With Iran, Vanishes From Federal Jail

- The White House Is Being Warned: North Korea Is Planning A “Devatstaing EMP Attack” On America

- Saudi “Deep State” Prince Bandar Among Those Arrested In Purge: Report

- Saudi ‘Corruption’ Probe Widens: Dozens Of Military Officials Arrested

- President Trump Accelerates Drone Strikes In Somalia

Finance

- Is Capitalism Dead Or Merely Dying?

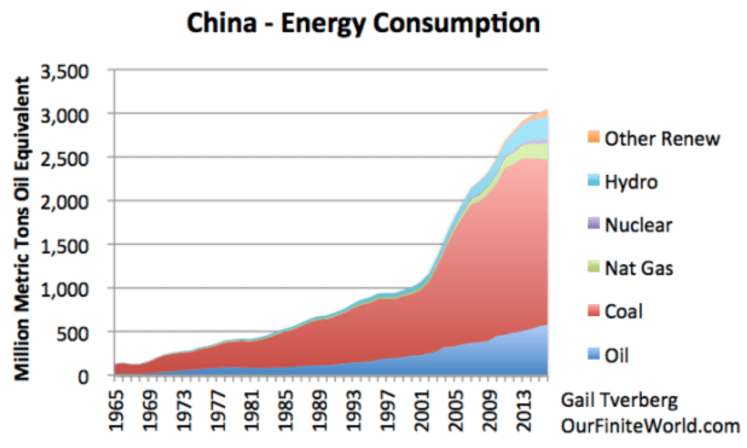

- “Lull Before The Storm” – Will China Bring An Energy-Debt Crisis?

- China Accounts For A Third Of Global Corporate Debt And GDP… And The ECB Is Getting Very Worried

- Deutsche: Every Time We Asked “How Much Lower Could Vol Go” Things Would Become Unpleasant

- How Corporate Zombies Are Threatening The Eurozone Economy

- Massive Hedge Fund CEO “Ready To Add Bitcoin To Investment Universe

- Crypto Chaos Explained – Bitcoin Crashes As ‘Cash’ Tops Ether For First Time

- Japan’s Plea To Millennials: Please Buy Stocks

- BOE Warns Weekly Fund Redemptions Of 1.3% Would Break Corporate Bond Market

- Financial Times: Sell Bitcoin Because The Market Is About To Become “Civilized”

Tech

- Tesla Unveils Its “Mind-Blowing” Semi And New Roadster, The “Fastest Production Car Ever Made” (see also Tesla Semi truck and Roadster event in 9 minutes)

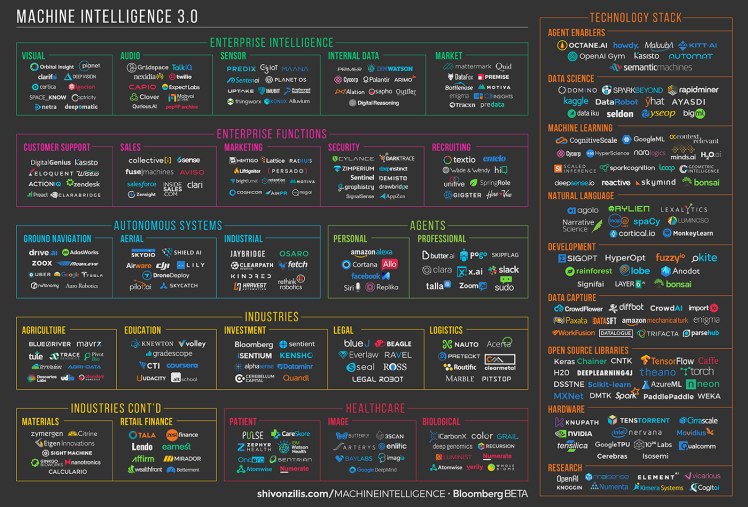

- The current state of machine intelligence 3.0

- Amazon Slashes Whole Foods Prices In Round 2 Of Grocer Wars

- Amazon Says It’s “Almost Ready” To Get 1,000s Of Grocery Store Cashiers Fired

- John Malone Describes Amazon As “Death Star” Moving “In Striking Range Of Every Industry On The Planet”

(with this excellent summary comment:

)

TED-Talks:

- How to transform apocalypse fatigue into action on global warming by Espen Stoknes

- The biggest risks facing cities — and some solutions by Robert Muggah

- An interview with Mauritius’s first female president by Ameenah Gurib-Fakim and Stephanie Busari